7 Wealth Metrics to Track Net Worth

Josh Pigford

Want to grow your wealth and track your financial health effectively? Start by monitoring these 7 key wealth metrics:

- Net Worth: Calculate your assets minus liabilities. Update monthly or quarterly for a clear financial snapshot.

- Quick vs. Long-term Assets: Balance liquid assets (cash, stocks) with long-term investments (real estate, retirement accounts). Aim for liquidity ratios that match your life stage.

- Debt Ratios: Keep your debt-to-asset ratio under 50% and debt-to-income under 36%. Regularly review all liabilities, including mortgages, credit cards, and loans.

- Investment Diversification: Spread investments across asset classes (stocks, bonds, real estate) and geographies. Rebalance annually to maintain your target allocation.

- After-Tax Worth: Account for taxes on retirement accounts, investments, and real estate to understand the true value of your assets.

- Real Wealth Growth: Adjust for inflation to measure the actual growth of your purchasing power over time.

- Long-term Wealth Planning: Prepare for the future with estate planning, risk management, and financial education for heirs.

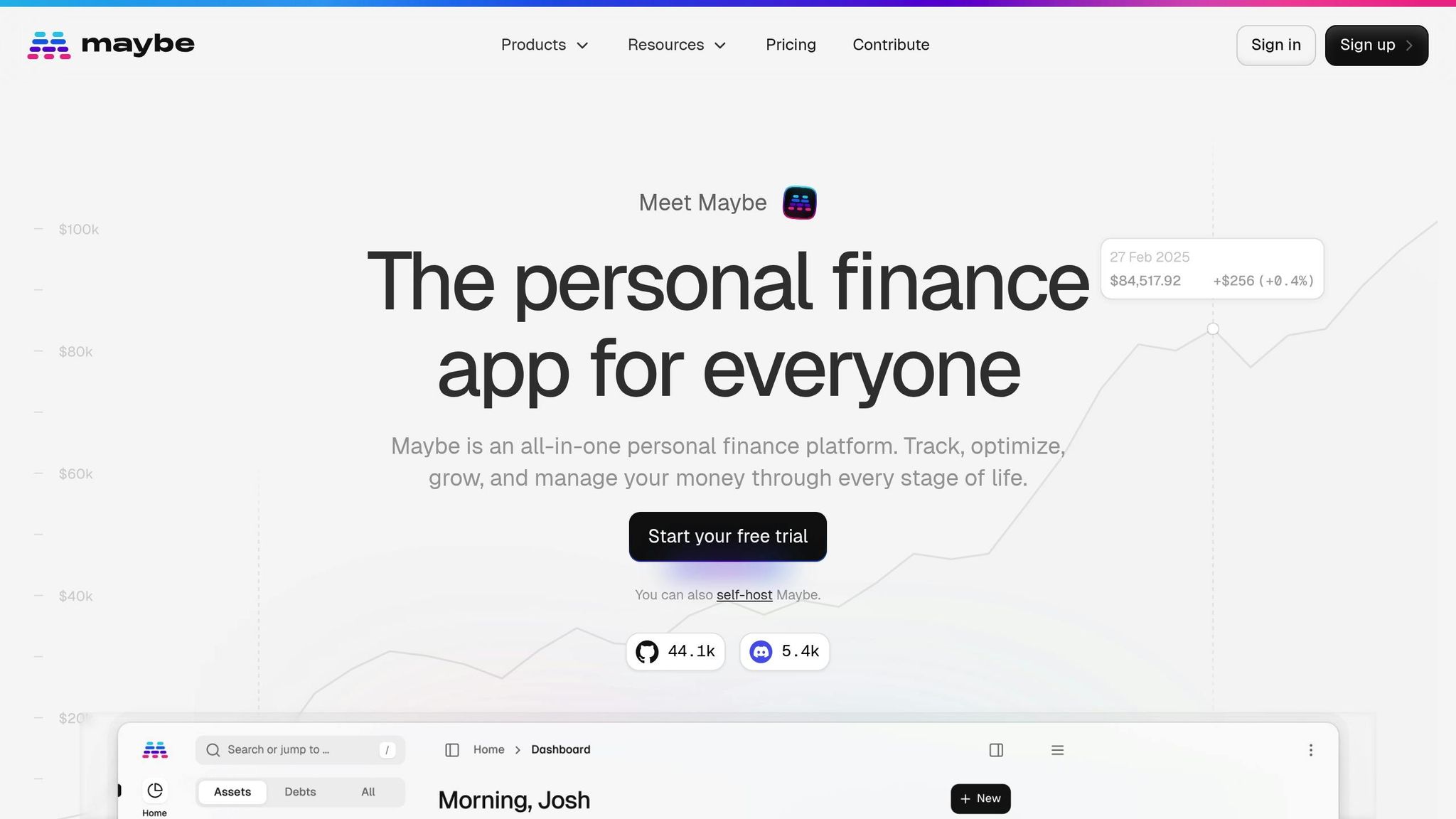

Why it matters: Tracking these metrics helps you identify opportunities, reduce risks, and make smarter financial decisions. Tools like Maybe Finance simplify this process by linking accounts, updating values in real-time, and providing AI-driven insights.

Quick Tip: Start with net worth tracking and gradually incorporate other metrics into your routine. Regular reviews keep you on track toward your financial goals.

1. Basic Net Worth Tracking

Tracking your net worth regularly is crucial for staying on top of your financial health. The formula is simple: Assets – Liabilities = Net Worth.

When calculating your assets, make sure to include:

- Cash and bank accounts

- Investment portfolios like stocks, bonds, or mutual funds

- Real estate valued at current market rates

- Retirement accounts such as 401(k)s and IRAs

- Valuable personal items

- Business interests

- Cash value of life insurance policies

On the liabilities side, account for:

- Mortgage balances

- Credit card debt

- Student loans

- Auto loans

- Personal loans

- Medical bills

- Tax obligations

This straightforward approach ensures you have an accurate snapshot of your financial situation.

For context, the median household net worth in the U.S. was $121,700 in 2019. Of course, this number varies widely based on age, income, and other factors. Instead of comparing yourself to others, focus on your own progress and goals.

Thomas J. Stanley's book The Millionaire Next Door highlights an interesting trend: many wealthy individuals achieve their net worth not through high incomes but through disciplined saving and modest lifestyles. Conversely, some high earners struggle to grow their net worth due to lifestyle inflation.

To monitor your progress, update your net worth monthly or quarterly. This frequency strikes a balance - allowing you to track trends without getting distracted by daily market fluctuations.

Be mindful of common errors that can skew your calculations:

- Using outdated purchase prices instead of current market values

- Forgetting to include all debts

- Double-counting assets across categories

- Overestimating the value of hard-to-sell items

- Ignoring vested employment benefits

For fluctuating assets like real estate or investments, rely on credible sources for accurate valuations. Real estate websites can provide home value estimates, while investment platforms show real-time portfolio data. When assessing personal property, apply a 20-30% discount to reflect realistic resale values. This approach ensures your net worth reflects a practical and honest financial picture.

2. Quick vs. Long-term Asset Balance

Balancing quick (liquid) and long-term (illiquid) assets is key to staying financially flexible. Quick assets are those you can turn into cash almost immediately - typically within days. On the other hand, long-term assets often require weeks, months, or even longer to convert into cash.

According to a 2022 Federal Reserve survey, only 15% of assets are liquid. This highlights the importance of maintaining a balanced mix of assets. Without enough liquidity, you could face financial stress during emergencies.

Here’s a simple breakdown of how accessible different asset types are:

| Asset Type | Typical Conversion Time | Examples |

|---|---|---|

| Quick Assets | Within days | Checking/savings accounts, money market funds, publicly traded stocks |

| Long-term Assets | Weeks to months or longer | Real estate, retirement accounts, business equity |

These categories can help you decide how much liquidity to aim for, based on your financial needs.

Recommended Liquidity Ratios by Life Stage

Your ideal balance of liquid and long-term assets changes as you move through different stages of life. Here's a general guideline:

- Early career (20s-30s): Aim for a 30:70 ratio of liquid to long-term assets.

- Mid-career (40s-50s): Shift to a 40:60 ratio.

- Pre-retirement (late 50s-60s): Balance out with a 50:50 ratio.

- Retirement: Prioritize liquidity with a 60:40 ratio.

In addition to these ratios, it’s wise to keep 3–6 months’ worth of expenses in liquid assets. This emergency fund ensures you can handle unexpected costs without disrupting your long-term investments.

Avoid Being 'Asset Rich but Cash Poor'

A 2023 Bankrate survey revealed that 25% of Americans have no emergency savings. This shows that even a high net worth can be misleading if most of your wealth is tied up in illiquid assets. To avoid this, consider these factors when evaluating your asset balance:

- Job Stability: If your income is unpredictable, you may need more liquid assets.

- Health Needs: Potential medical expenses might require a larger cash reserve.

- Upcoming Big Expenses: Plan ahead for major purchases or financial commitments.

- Investment Opportunities: Keep some cash on hand to take advantage of strategic opportunities.

- Market Conditions: During volatile times, a higher liquidity level can provide peace of mind.

Just as tracking your net worth gives you an overall financial snapshot, understanding your asset liquidity fine-tunes your strategy. Tools like Maybe Finance can simplify this process by linking your accounts, visualizing your asset breakdown, and offering AI-driven insights. Regularly reviewing your asset balance can help you stay prepared for emergencies and make the most of opportunities.

3. Debt Management Ratios

Grasping your debt management ratios is a key step in understanding your financial health. These metrics show how well you're managing debts in relation to your assets and income, helping you pinpoint areas for improvement and potential risks.

Core Debt Ratios to Monitor

Here are three essential debt ratios you should keep an eye on:

| Ratio Type | Formula | Target Range | Purpose |

|---|---|---|---|

| Debt-to-Asset | Total Liabilities ÷ Total Assets | Below 50% | Indicates what portion of assets is funded by debt |

| Debt-to-Income | Monthly Debt Payments ÷ Monthly Gross Income | Below 36% | Assesses your ability to manage monthly debt payments |

| Debt Service Coverage | Net Operating Income ÷ Total Debt Service | Above 1.0 | Measures your capacity to cover debt obligations |

Interpreting Your Ratios

The Consumer Financial Protection Bureau suggests keeping your debt-to-income ratio under 36%, with no more than 28% dedicated to housing costs like rent or mortgage payments. This standard aims to maintain financial flexibility and prevent overextension.

For the debt-to-asset ratio, staying below 50% means your assets outweigh your liabilities - an indicator of financial stability. However, these benchmarks should align with your personal financial goals and life stage. For instance, younger individuals might temporarily see higher ratios due to student loans or mortgages, while those approaching retirement should aim for lower ratios to reduce financial risks.

Common Interpretation Mistakes

A frequent error is focusing only on mortgage debt while ignoring other obligations. A full picture of your financial health requires factoring in all debts, such as:

- Credit card balances

- Student loans

- Personal loans

- Auto loans

- Business-related debt

Additionally, it’s vital to keep asset values updated regularly to ensure your debt ratios are accurate.

Improving Your Ratios

Here’s an example: Someone reduced their debt-to-asset ratio from 45% to 28% by tackling high-interest debt first and increasing investments.

To improve your own ratios, consider these steps:

- Prioritize high-interest debt repayments to reduce financial strain.

- Review your ratios monthly and update asset valuations quarterly.

- Explore debt consolidation options if juggling multiple high-interest debts.

Tools like Maybe Finance make this easier by automatically tracking your debts and assets through linked accounts. With real-time calculations and AI-driven insights, it helps you maintain a clear and accurate view of your financial standing. The platform supports connections to over 10,000 financial institutions, ensuring thorough debt monitoring.

4. Investment Diversification Levels

Keeping your investments diversified is key to safeguarding your net worth and managing market fluctuations. Just like monitoring debt ratios and asset liquidity, diversification fine-tunes your overall financial strategy.

Measuring Portfolio Diversification

To track diversification effectively, start by evaluating how your assets are spread across different investment categories. Here's an example of asset allocation based on varying risk levels:

| Risk Profile | U.S. Stocks | International Stocks | Bonds | Real Estate | Cash |

|---|---|---|---|---|---|

| Conservative | 30% | 10% | 40% | 10% | 10% |

| Moderate | 45% | 15% | 25% | 10% | 5% |

| Aggressive | 60% | 20% | 10% | 5% | 5% |

Key Metrics for Diversification

- Asset Class Distribution: Break down your portfolio by major asset types - stocks, bonds, real estate, and cash - and calculate the percentage allocated to each.

- Sector Exposure: Review your stock investments across industries to avoid overloading any single sector. A good rule of thumb is to keep sector exposure below 25% of your stock portfolio.

- Geographic Spread: Balance your investments geographically. For U.S. investors, this often means allocating 70–80% to domestic assets and 20–30% to international markets.

Rebalancing Your Portfolio

It’s wise to review your portfolio annually or after major market changes. If your asset allocation strays too far from your targets, consider rebalancing by selling overrepresented assets and purchasing those that are underweighted.

Advanced Diversification Tracking

Beyond the basics, advanced tracking involves analyzing how different assets move in relation to each other. Assets with low or negative correlations can add another layer of stability to your portfolio. Here are some typical correlations:

| Asset Pair | Typical Correlation |

|---|---|

| U.S. Stocks / U.S. Bonds | -0.3 |

| U.S. Stocks / International Stocks | 0.6 |

| Stocks / Real Estate | 0.5 |

| Bonds / Real Estate | 0.2 |

Maybe Finance’s Role in Diversification

Maybe Finance simplifies diversification tracking by automatically calculating your asset allocation and offering clear, visual breakdowns. Its AI-powered tools can alert you when your portfolio drifts from your target allocations, helping you maintain balance across all your connected accounts.

Common Diversification Pitfalls

- Holding overlapping or redundant investments

- Ignoring international markets

- Overconcentrating in employer stock

- Overlooking how different investments correlate

5. After-Tax Worth Calculation

To get a clear picture of your true net worth, it’s crucial to account for future tax liabilities. While your investment accounts might look impressive on paper, taxes can significantly reduce their actual value.

Tax Impact by Asset Type

Not all assets are taxed the same way, and this directly affects their real-world value:

| Asset Type | Tax Consideration | Typical Tax Impact |

|---|---|---|

| Traditional 401(k)/IRA | Income tax on withdrawals | 20-35% reduction |

| Taxable Investments | Capital gains tax | 15-23.8% on gains |

| Rental Property | Capital gains + depreciation recapture | 15-25% on appreciation |

| Roth Accounts | Tax-free qualified withdrawals | No reduction |

Calculating After-Tax Values

To determine the after-tax value of your assets, adjust for the potential tax impact as follows:

- Traditional Retirement Accounts: Multiply the account balance by (1 - your tax rate).

- Investment Accounts: Subtract the capital gains tax from unrealized gains.

- Real Estate: Factor in capital gains taxes and depreciation recapture for appreciation exceeding exclusion limits.

- Roth Accounts: Include the full account value, as qualified withdrawals are tax-free.

Hidden Tax Obligations

Taxes can take a significant bite out of your wealth. For example, a $500,000 traditional 401(k) might only be worth $355,000 after taxes if you're in a 29% tax bracket. Similarly, an investment portfolio valued at $200,000 with $80,000 in unrealized gains could face a $16,000 tax hit at current capital gains rates.

Tax-Efficient Asset Location

Maybe Finance simplifies this process by giving you a detailed view of how taxes impact your portfolio. The platform automatically classifies accounts based on their tax treatment and calculates estimated after-tax values tailored to your tax situation.

Regular Review and Adjustment

Your after-tax net worth isn’t static - it changes over time due to:

- Updates to tax laws

- Shifts in your tax bracket

- Market value fluctuations

- New contributions or withdrawals

Make it a habit to review your after-tax calculations yearly, especially if there are changes in tax laws or your financial situation.

Geographic Considerations

State taxes also play a big role in your after-tax worth. For instance, moving to a state like Florida, which has no income tax, could save you significantly compared to states like California, where income tax rates can climb as high as 13.3%. Be sure to account for your state’s tax rules, especially if you’re considering relocating in retirement.

6. Real Wealth Changes Over Time

When tracking your wealth over time, it's crucial to factor in purchasing power. While your net worth might appear to grow in dollar terms, inflation can eat away at what that money can actually buy.

Measuring Real Growth

To truly understand how your wealth has grown, you need to account for inflation. For example, if your net worth increased from $50,000 in 2015 to $80,000 in 2025, it might seem like a $30,000 gain. But with cumulative inflation of 25% over that period, the $50,000 from 2015 would equal $62,500 in 2025 dollars. This means your real wealth grew by $17,500, not $30,000. Adjusting for inflation gives a clearer picture of your financial progress.

Impact of Recent Inflation

Recent years have shown how inflation can reduce the value of nominal gains. For instance, between 2021 and 2023, U.S. inflation at times topped 6%, which significantly impacted real growth.

| Year | Nominal Growth | Inflation Rate | Real Growth |

|---|---|---|---|

| 2022 | 7.0% | 6.5% | 0.5% |

| 2023 | 5.0% | 3.2% | 1.8% |

Growth Targets and Tracking

When setting financial goals, it's important to adjust for expected inflation. For example, aiming for a 7% increase in net worth during a year with 3.2% inflation translates to a real gain of about 3.8%. Tools like Maybe Finance make this process easier by automating inflation adjustments and helping you visualize your financial health. These tools can help you:

- Track changes in your purchasing power

- Spot periods where inflation erodes wealth

- Refine your investment strategies based on real returns

- Make smarter decisions about saving and spending

Geographic Considerations

Inflation’s impact isn’t uniform across the country. In some cities, housing costs and other expenses may rise faster than the national average, which means your real purchasing power could vary significantly depending on where you live.

Regular Review Schedule

To stay on top of your finances, consider this review schedule: check your nominal net worth monthly, evaluate inflation trends quarterly, and assess real growth annually. This routine can help you stay aligned with your long-term financial goals.

7. Long-term Wealth Planning

After tracking your net worth and analyzing assets, the next step is planning for long-term financial security and ensuring your legacy.

When aiming to build intergenerational wealth, you'll need to look beyond just net worth. Consider factors like estate tax exposure, liquidity ratios, and the effectiveness of wealth transfers. For instance, maintaining a healthy liquidity ratio ensures you have enough cash on hand for unexpected expenses while keeping most of your assets invested for growth. This broader perspective naturally ties into solid estate planning.

Estate planning plays a key role in safeguarding and passing on wealth. It involves strategies like establishing trusts, planning tax-efficient transfers, and regularly reviewing key documents. Collaborating with financial advisors ensures your estate plan stays aligned with your goals and adapts to changes over time.

To measure the success of wealth transfers, use both numbers - such as the percentage of assets successfully passed on - and softer measures, like how financially prepared your family is. Tools like Maybe Finance can help you visualize how assets are allocated across generations and track progress.

Protecting wealth also means managing risks effectively. Keep an eye on portfolio diversification, avoid overextending with debt, and update your estate plan regularly with professional input.

At the same time, preparing your heirs is just as important. Organize family meetings and financial education sessions to ensure the next generation is ready to handle their responsibilities. Tracking participation in these efforts can help improve the success of wealth transfers.

Modern tools like Maybe Finance make it easier to centralize family financial information, providing real-time insights on portfolio performance, tax strategies, and estate planning.

Finally, revisit your wealth plan every year or after major life changes. Use these reviews to fine-tune your asset allocation, update estate documents, refine risk management strategies, and strengthen family financial education efforts.

Conclusion

Keeping an eye on wealth metrics gives you a clear picture of your financial standing and helps you make smarter decisions for the future. By focusing on these seven key metrics, you can build a strong foundation for growing and protecting your wealth.

Tools like Maybe Finance make this process easier by pulling data from over 10,000 institutions, ensuring your tracking stays accurate and up-to-date without eating up your time. To get started with effective wealth tracking, follow these steps:

- Link all your accounts to create a complete financial snapshot.

- Set up regular reviews - monthly for basic metrics and quarterly for more detailed evaluations.

- Use automation to factor in real wealth adjustments like inflation and taxes.

By combining these habits with your key metrics, you can keep your financial strategy focused and flexible. Consistent reviews and adjustments are essential as your financial situation changes. Maybe Finance's customizable dashboards can help you fine-tune your approach as your portfolio grows.

Effective wealth tracking isn't just about gathering numbers - it’s about turning those insights into better financial choices.

FAQs

How often should I update my net worth to keep it accurate and up to date?

To ensure your net worth calculations stay accurate, it's smart to update them once a month. This regular check-in helps you track changes in your income, expenses, investments, and debts without it becoming too overwhelming.

If something big happens financially - like purchasing a house, getting a hefty bonus, or paying off a large chunk of debt - you might want to update your numbers sooner. Keeping tabs on your net worth regularly keeps you informed about your financial progress and helps you make smarter decisions to build your wealth.

What mistakes should I avoid when calculating and understanding my debt management ratios?

When working with your debt management ratios, there are a few common mistakes you’ll want to steer clear of:

Relying on outdated or incomplete data: Always ensure you're using the latest and most accurate financial details. This includes all debts, interest rates, and income sources. Missing or old information can throw off your calculations and lead to misleading conclusions.

Overlooking the bigger picture: Ratios like debt-to-income (DTI) or debt-to-asset are helpful, but they don’t give the full picture. Keep other factors in mind, such as interest rates, repayment terms, and your broader financial goals, when analyzing these numbers.

Focusing on just one ratio: A single ratio might highlight one aspect of your financial situation, but it’s crucial to consider multiple metrics to get a well-rounded view of your overall financial health.

By being mindful of these pitfalls, you can gain a clearer understanding of where you stand financially and make smarter decisions for improving your long-term financial well-being.

How can I help my heirs become financially responsible and prepared for wealth transfer?

Preparing your heirs for the transfer of wealth requires a mix of financial education and honest communication. Begin by helping them develop essential skills like budgeting, saving, and investing. These fundamentals will strengthen their understanding of financial management and set them up for long-term success.

It’s also important to share your family’s values and goals related to money. This can give them a sense of purpose and responsibility when it comes to managing wealth. Open conversations about your estate plan are equally valuable. Take the time to explain how assets will be divided and any responsibilities they might take on in the future.

For added clarity, you could work with a financial advisor or use tools like Maybe Finance. These resources can help you organize your assets and present a straightforward financial overview, making the process easier for everyone involved.

Subscribe to get the latest updates right in your inbox!