How to make fixed income part of your investing strategy

Josh Pigford

Fixed income securities are a type of debt instrument under which the borrower or issuer is obligated to pay the purchaser/holder of the fixed income instrument a fixed amount of money on a set schedule.

They generally provide regular, consistent returns at periodic intervals that are paid out to the investor and promise to repay the principal amount to the investor at maturity (duration of the loan). The most common fixed-income instruments are government and corporate bonds, which use the investors’ capital (acquired from selling the bonds to investors) to finance their operations.

Fixed income instruments are generally less risky when compared to stocks and provide a stable income in the form of interest at regular time intervals.

Types of fixed income instruments

There are a variety of financial instruments that you can choose from when it comes to generating fixed income for your retirement or for financing a particular goal. The major ones you can look at are:

Bonds

Bonds are financial instruments in which you as an investor offer your investment as a loan or debt to an issuer. The issuer (a government or a company) promises to repay your investment principal and a fixed amount of interest as a coupon at regular intervals.

The different types of bonds in order of ascending risk/reward profiles (low to high risk/reward) are:

- Treasury bonds (T-Bonds): T-bonds are issued by the U.S. government and have a maturity that is greater than 20 years. T-bonds earn periodic coupon payments (or interest) until maturity, where your principal as an investor is paid out. These are the lowest-risk bonds because the federal government backs them, generally giving lower returns.

- Municipal bonds: Municipal bonds are similar to treasury bonds, but the debt is issued and backed by a state, municipality, or county instead of the federal government. Certain investors (high tax bracket) prefer municipal bonds. These bonds have some tax benefits like exemption from federal tax on interest received from municipal bonds, and sometimes even state and local taxes are exempt. They have a similar risk/reward balance to T-bonds.

- Corporate bonds: Corporate bonds are a type of debt issued by a company and sold to investors like you and me. The reason companies generally issue bonds is to raise capital from investors to expand their business. Typically, riskier companies offer higher interest rates/coupon payments to compensate the investor for the risks. Therefore, there is enormous variability in corporations’ interest/coupon payments.

- Junk bonds (High-yield bonds): Junk bonds are corporate bonds that pay a higher coupon payment due to a higher default probability. Struggling companies often pay higher coupon payments but are more likely to fail to repay the principal or coupon payments to the investor, which is considered a default. Junk bonds are riskier than corporate bonds as they are generally issued by struggling companies with high debt and risk of bankruptcy.

Treasury bills and Treasury notes:

T-bills (not the same as T-Bonds) are short-term U.S. government-backed debt obligations that the treasury department issues. They have a maturity of one year or less.

T-notes offer a fixed rate of interest semi-annually till maturity, and they have a maturity of 2, 3, 5, 7, and 10 years. The longer duration T-notes offer higher interest than the short term T-notes as the default risk (however small) increases over more extended periods.

Treasury Inflation-Protected Securities (TIPS):

TIPS is a security that the U.S. government issues to protect investors from reducing purchasing power due to inflation. If you buy TIPS and inflation increases, the interest or yield doesn't increase. However, the price of the TIPS adjusts to maintain the actual value. TIPS provides greater investor protection than short-term bonds and similar instruments when interest rates rise.

Fixed-income mutual funds and ETFs:

Fixed-income mutual funds and ETFs (exchange-traded funds) by Vanguard and similar groups like Charles Schwab, Fidelity, etc., offer investors a diversified portfolio of fixed-income instruments (mainly bonds). A diversified fixed-income portfolio via a mutual fund or ETF can eliminate company or corporation-specific risks. Hence, the only risk you have to endure is the market risk.

Investing in these funds also reduces the complexity of picking and choosing fixed-income instruments to add to your portfolio and provides you with an all-in-one solution. However, investors have to pay a small management fee for these conveniences. Nowadays, several major groups like Vanguard offer funds with small management fees (expense ratios) of 0.035% of assets annually. But other groups and companies will charge higher fees, so be sure to do your due diligence when looking into them.

Certificates of deposit (CD):

A CD is a fixed-income instrument that helps you as an investor earn a little more interest than a bank savings account. C.D.s are generally offered to investors by financial institutions and have maturities of less than five years.

Risks of fixed-income instruments

There are different types of risks associated with holding fixed income instruments. We will cover some of the significant risks below to understand better the risks associated with these instruments.

- Interest rate risk: You, as a holder of bonds and other fixed-income instruments, are exposed to interest rate risk, which arises from fluctuating interest rates. As the interest rates increase, the value of the bond decreases. Therefore, there is an inverse relationship between interest rates and the bond value.

- Credit risk: Credit risk covers the probability that you incur a loss when the instrument's issuer fails to pay back your principal or coupon payments. It includes both default risk and inferior performance (lower coupon payments).

- Inflation risk: Inflation risk, also known as purchasing power risk, is the risk that inflation will reduce the purchasing power of the coupon payments issued by the bondholder. For example, if the interest or coupon payments for a bond are at 3% and inflation is at 7%, you lose purchasing power by keeping your principal invested in the bond. Generally, as coupon payments are fixed, they are heavily influenced by inflation.

- Liquidity risk: Liquidity can generally be defined as the difference between the security buy and sell prices. If you purchase low-liquidity instruments, you might have to sell bonds at low rates as the differences in buy and sell prices (aka the spread) will be huge. The lower the liquidity, the higher the liquidity risk of an instrument.

Comparing Stocks and Fixed Income

- Ownership : When you purchase a stock, you buy ownership in a company and are entitled to a portion of its future cash flows. However, when you buy fixed-income securities like bonds, you are loaning your money to the organization issuing the instrument as debt, with the promise that they will give you back your principal in full and interest at fixed intervals.

- Seniority: If a company goes bankrupt or is liquidated, the stockholders of a company undergoing bankruptcy/liquidation are considered after all other debt holders (which have higher seniority when it comes to company assets) have been taken care of which means there may not be anything left to salvage for the stockholders. Fixed income or debt instruments are generally safer than equity holdings in case of bankruptcy/liquidation because you are considered a debt holder rather than a stockholder.

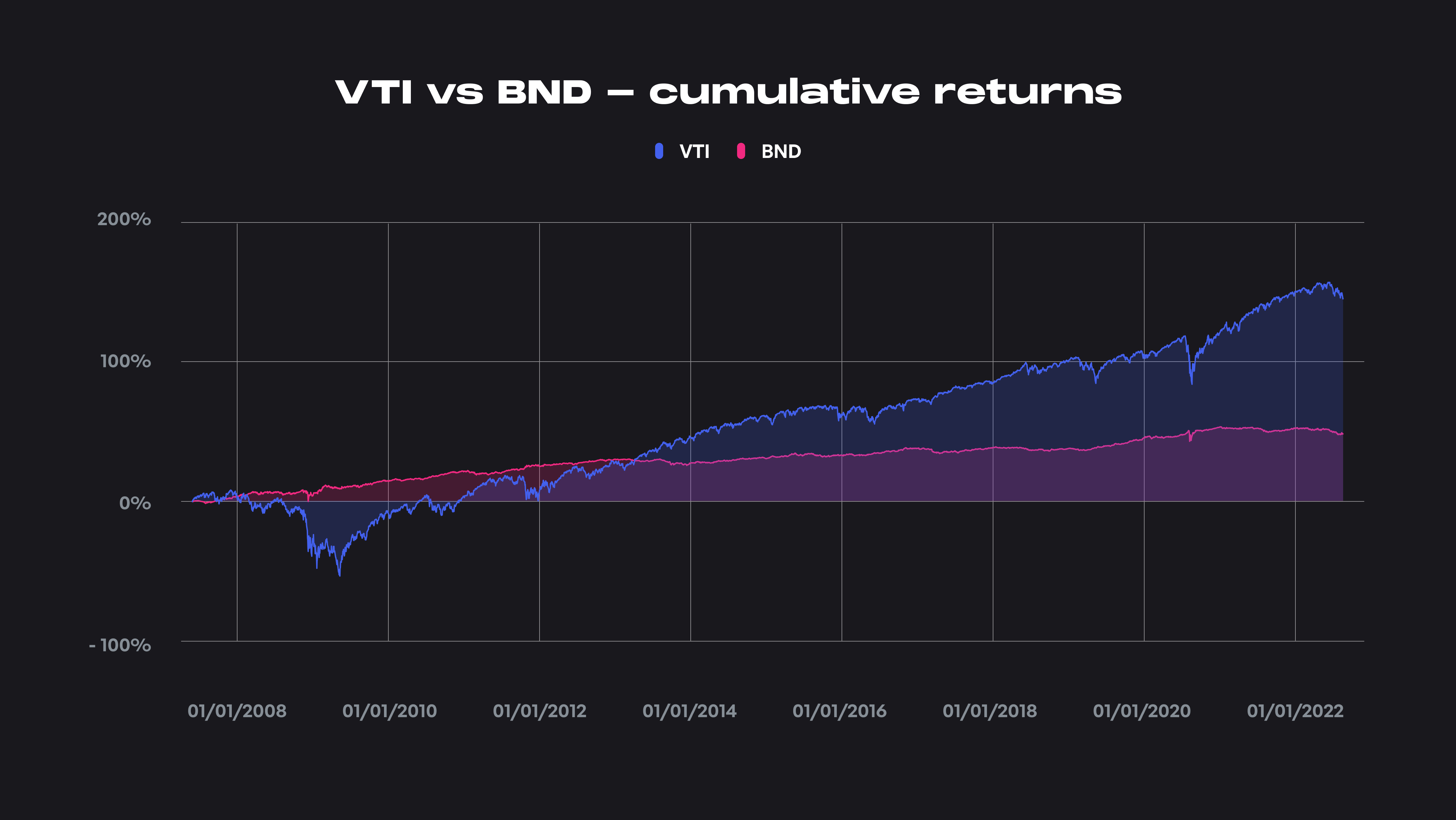

- Returns: Stocks are generally considered more volatile and riskier than bonds (more risk, more return). To see the difference in returns between stocks and bonds, let's compare two broad-market index fund ETFs—the Vanguard Total Stock Market Index Fund ETF Shares (VTI), which represents almost 100% of the total investable U.S. public equities market, and the Vanguard Total Bond Market Index Fund ETF Shares (BND) which provides broad, market-weighted exposure to the U.S. bond market.

From April 2007 to February 2022, the stock market fund (VTI) has given an annual return (calculated by CAGR) of 6.95% (due to an initial fall in stock prices due to the financial crisis), and the bond market fund has given an annual return of 3.37% (with significantly lower volatility). From the graph, we can also infer that bonds don't fall drastically during moments of crisis, such as the 2008 financial crisis (see below).

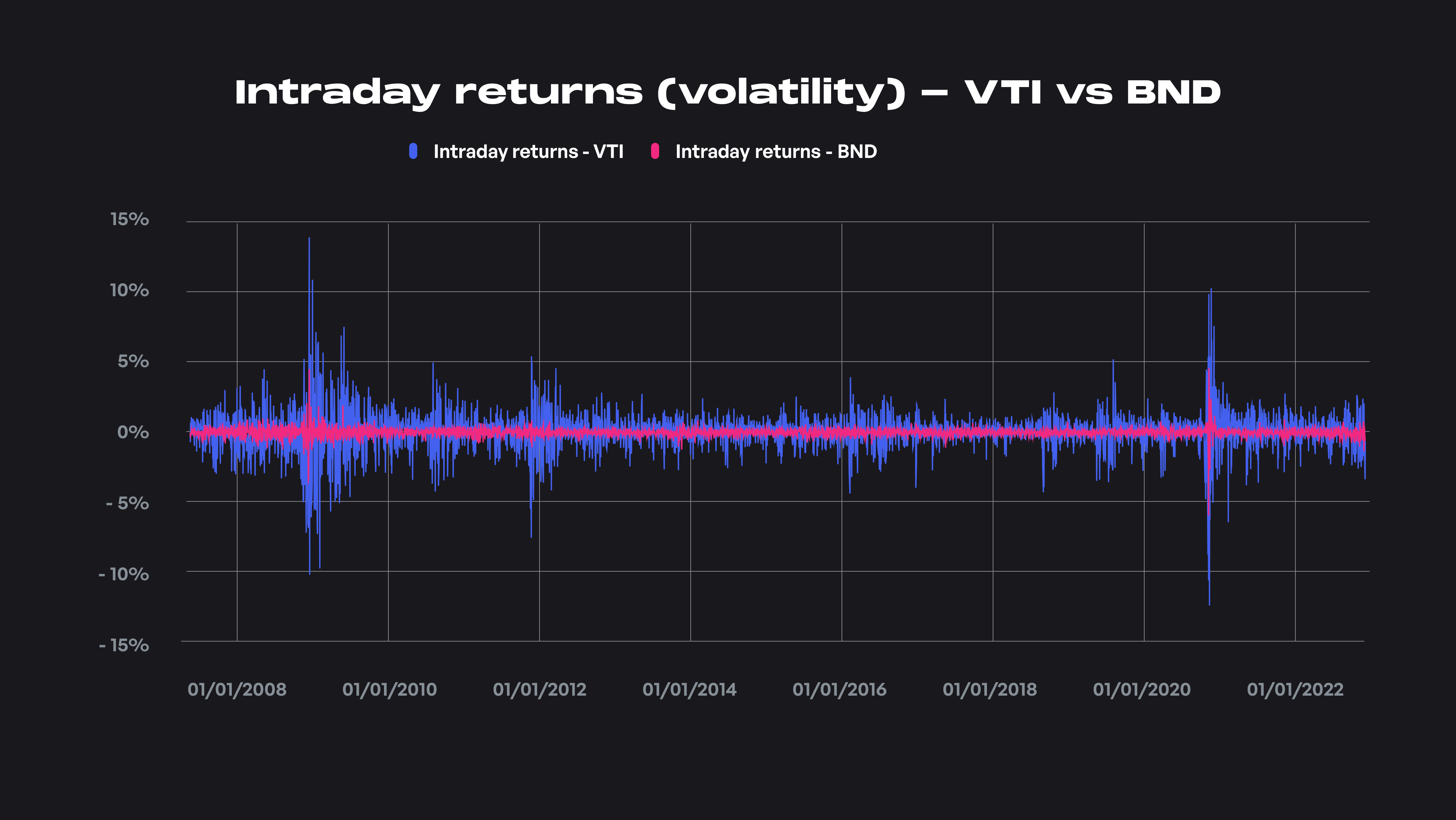

- Volatility: Bonds and other fixed-income instruments are generally much less volatile than even a diversified portfolio of stocks (such as index funds). This low volatility makes bonds an ideal asset class for retirement portfolios. Huge fluctuations in the value of your portfolio during your retirement years are not advisable, as you will have to withdraw money from your portfolio every month for expenses. Large fluctuations in portfolio value can make you susceptible to selling off your investment asset at depressed prices, which might cause you to run out of money from your retirement portfolio much sooner than expected.

In the graph below (data and analysis here), we can see the month-to-month fluctuations in the prices of stocks (red line) and bonds (blue line). We have used the adjusted prices (including dividends) of the Vanguard Total Bond Market Index Fund ETF Shares (BND) for the bond prices. BND provides the investor exposure to the entire U.S. bond market via a broad, market-weighted bond index that excludes inflation-protected and tax-exempt bonds.

For the stock prices, we have used monthly price data of the Vanguard Total Stock Market Index Fund ETF Shares (VTI), which tracks the performance of the CRSP U.S. Total Market Index, which contains nearly 4000 companies across mega, large, small, and micro capitalizations, representing almost 100% of the U.S. investable equity market.

The graph shows that stock prices fluctuate much higher/lower than the mean, even monthly. This analysis shows that stocks are much more volatile than bonds. Your portfolio will fluctuate more (more volatile) as your allocation to stocks increases and become less volatile as your allocation to bonds increases.

Monthly volatility (VTI vs. BND):

Daily volatility (VTI vs. BND):

(More granular data and analysis here.)

Performance analysis of bond funds

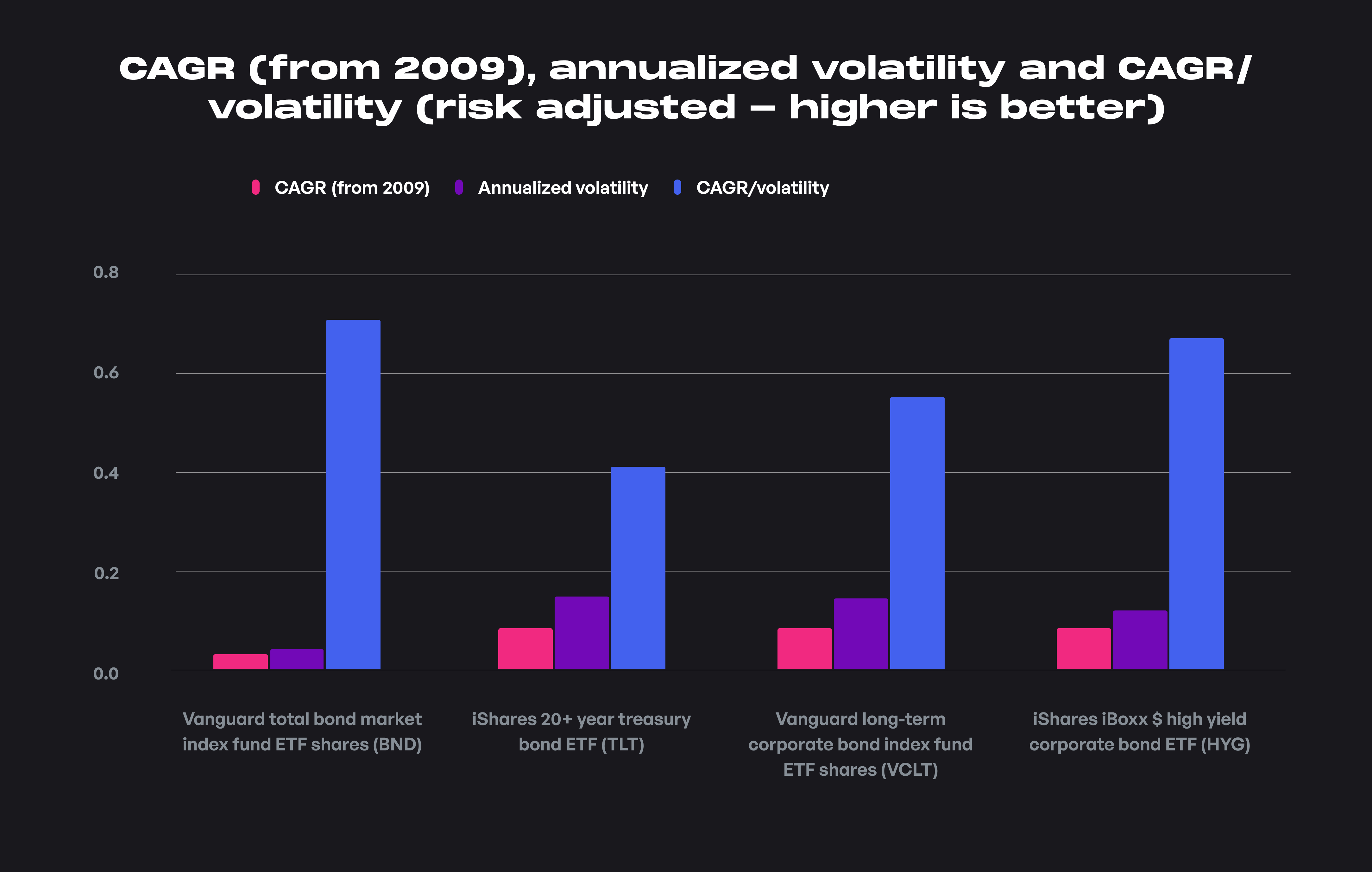

The most significant portion of your fixed-income portfolio will likely consist of various bonds, so taking a deeper dive into the performance of different bond funds can help you make a better decision on what bonds you wish to hold.

Below you can see the returns (CAGR), volatility, and derivatives of various bond ETF funds catering to different types of funds like Treasury bonds (T-bonds), Corporate bonds, High-yield bonds (Junk bonds), and Total bond market funds.

(You can find the complete data and analysis here.)

Below are the cumulative returns of the various bond fund ETFs including the Total Bond Market Fund ETF (BND), 20-year Treasury Bond ETF (TLT), Long-Term Corporate Bond ETF (VCLT), and the High-Yield Corporate Bond ETF (HYG).

Bond portfolio strategy

A simple strategy you can follow while building up your bond portfolio is using a total bond market index fund or ETF as a core portfolio where you invest 70-100% of your bond allocation. Based on your risk tolerance, you can also compliment your core portfolio with a satellite portfolio (0-30% allocation) containing various instruments such as TIPS, high-yield bonds, T-bills, C.D.s, etc.

Key takeaways

- If you're an investor in a fixed income instrument, you are entitled to get a fixed amount of money at regular intervals as long as you hold the instrument or until maturity. Government bonds and corporate bonds are the most common fixed-income instruments.

- Fixed income instruments generally offer a lower return (with lower volatility) than stocks in the long term. Still, they have some advantages like a fixed return every year at regular intervals and a preference over equity investors during liquidation/bankruptcy of the issuing organization.

- Fixed income instruments like bonds can be a valuable addition to the portfolio of investors who want relatively stable returns at regular intervals of time with lower volatility. This stability is why bonds are a staple in retirement portfolios, where the interest from your bonds is used to replace your income.

Subscribe to get the latest updates right in your inbox!