How to Track Multiple Income Sources

Josh Pigford

Want to manage your income streams effectively? Start by tracking them. Here's why:

- Over 45% of Americans now rely on side hustles to secure their finances.

- Tracking income helps you identify trends, focus on what works, and avoid missed opportunities.

Steps to track your income:

- List all income sources: Include active (salary, freelance), passive (rent, dividends), and portfolio (investments).

- Separate fixed and variable income: This helps with budgeting and planning.

- Use tools: Spreadsheets for manual tracking or automated platforms like Maybe Finance for efficiency.

- Organize accounts: Set up separate bank accounts for each income stream.

- Review regularly: Analyze patterns, adjust strategies, and focus on the most profitable sources.

Step 1: Find and Group Your Income Sources

To effectively track your income, the first step is to identify every source of earnings and understand how they function. Categorizing these sources helps you see where your money comes from and how reliable those streams are.

Make a Complete List of All Income

Start by pulling together your bank statements, tax returns, and payment records from the last three months. Write down every source of income, no matter how small or irregular it might be.

Income generally falls into three main categories:

- Active income: Money earned through work, like salaries, hourly wages, freelance gigs, or commissions.

- Passive income: Earnings that require little ongoing effort, such as rental income, dividends, or royalties.

- Portfolio income: Returns from investments, including interest payments and capital gains.

"If you don't find a way to make money while you sleep, you will work until you die."

For each source, note how much you typically earn and how often you receive payments. Even smaller amounts, like occasional freelance jobs or small dividends, can add up over time and are worth tracking.

Separate Fixed Income from Variable Income

Once you've listed all your income sources, divide them into two groups: predictable income and income that varies. This step is key to creating a practical budget and financial plan.

- Fixed income includes stable, regular earnings like salaries or steady rental payments.

- Variable income fluctuates, such as freelance work, commissions, or irregular bonuses.

Fixed income offers consistency, making it easier to cover essential expenses like rent, insurance, or loan payments. Variable income, on the other hand, requires more attention since it can change from month to month - but it also provides opportunities for extra savings or investments.

To stay organized, consider setting up separate sections in your tracking system: one for stable income and another for variable earnings. This way, you can plan your budget around the predictable money while treating variable income as a bonus for reaching financial goals, like paying off debt or growing your savings.

Now that your income is sorted and categorized, you’re ready to explore tools that make tracking and managing it easier.

Step 2: Pick the Right Tools to Track Your Income

After identifying and organizing your income sources, the next step is finding the right tools to keep track of them. Your choice will depend on how comfortable you are with technology and how much time you’re willing to dedicate to managing your finances. Below, let’s weigh manual tracking against automated solutions to help you decide what works best for you.

Track Income Manually with Spreadsheets

Spreadsheets give you the flexibility to customize your tracking process, but they require you to input all data manually. While this approach offers control, it’s prone to errors and can become a time drain, especially if you’re juggling multiple income streams.

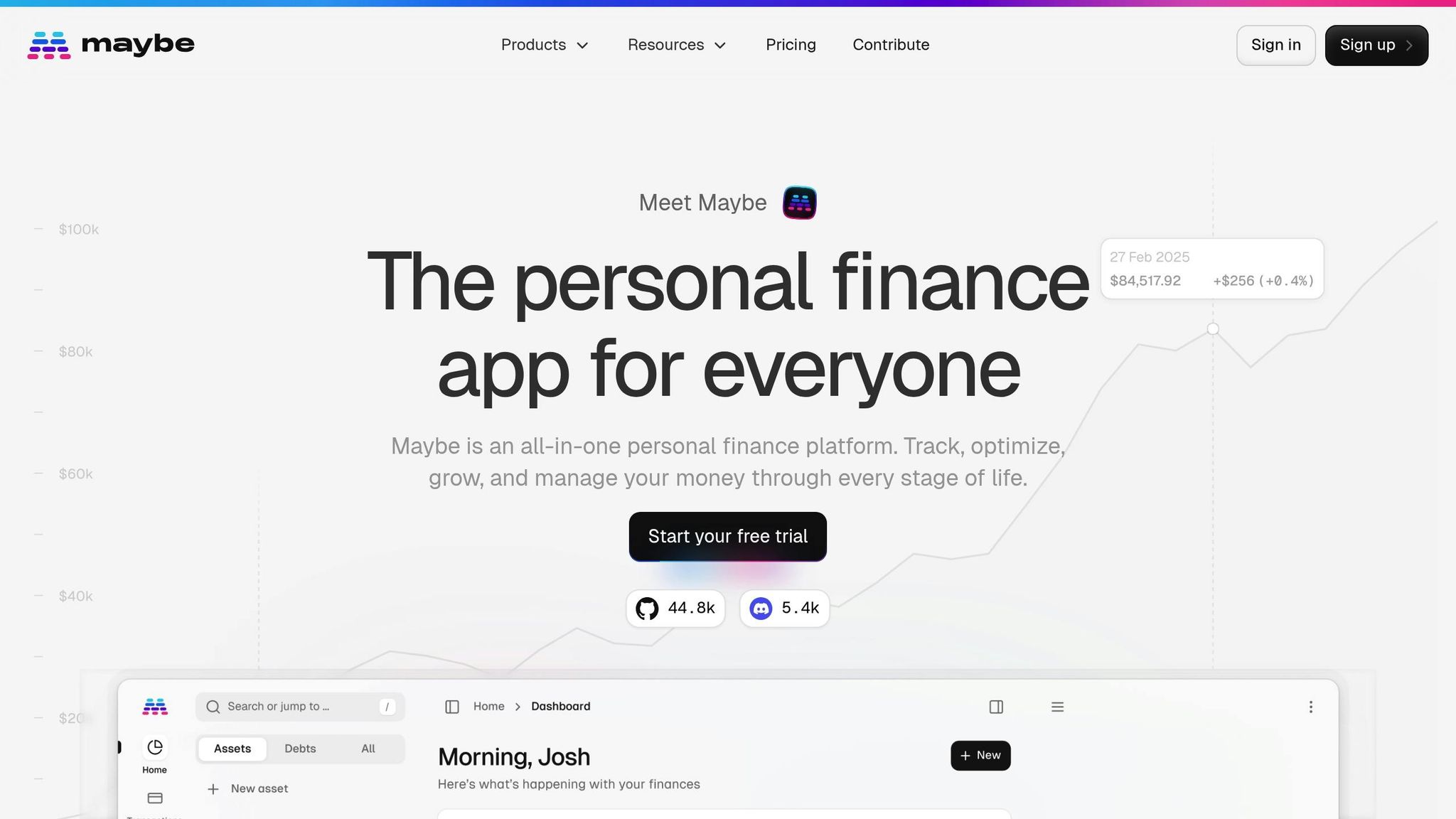

Automate Income Tracking with Maybe Finance

For a more efficient solution, Maybe Finance offers automated tracking that connects directly to your financial accounts. This platform syncs with over 10,000 institutions, importing your transaction data and categorizing it without the need for manual entry.

Here’s why Maybe Finance stands out:

- Multi-currency support: Ideal for those earning internationally or working with clients who pay in different currencies.

- AI-powered insights: These help you spot income trends and make smarter financial decisions.

- Data control: Maybe Finance is open-source, giving you the option to self-host using Docker for maximum privacy. Alternatively, you can use their managed hosting service, currently in alpha release via invites on Discord.

Automation doesn’t just save time - it significantly reduces errors, cuts back-office expenses, and can free up several hours each week.

"Automation is the future of small business accounting. By leveraging technology to handle routine tasks like expense tracking, business owners can focus on growth and innovation."

- Jared Weitz, CEO and Founder of United Capital Source Inc.

Maybe Finance simplifies income tracking with features like automated connections, AI-driven insights, and real-time updates. It even tracks investment performance, making it a comprehensive tool for those looking to manage their finances without deep accounting expertise.

Choosing the Right Approach

Your decision between manual and automated tracking will depend on your unique needs. If you have only a handful of income sources and prefer hands-on control, spreadsheets might be sufficient. But if you’re dealing with multiple streams, frequent transactions, or want to minimize errors while saving time, an automated tool like Maybe Finance could be the smarter choice.

"Invest in a user-friendly accounting software that integrates with your business bank account and credit card for automatic expense categorization and real-time financial insights."

- Yoseph West, CEO of Relay Financial

Step 3: Keep Your Income Streams Organized

Once you’ve set up the right tools, the next step is organizing your income streams. This helps simplify your financial management, reduces confusion, and makes tax season far less stressful.

Use Separate Bank Accounts for Each Income Stream

One of the easiest ways to stay organized is by setting up different bank accounts for each income source. When all your earnings are lumped into a single account, it can be tough to figure out where your money is coming from - especially if you’ve got multiple ventures running at the same time.

By keeping accounts separate, you’ll get a clear picture of how each income stream is performing. You’ll also spot irregularities faster and make tax prep a breeze. Take Angela, for example. She’s a graphic designer who earns from her agency, an Etsy shop, a YouTube channel, and stock investments. By using separate accounts for each, she can easily track how much each source contributes to her total income and adjust her efforts where it counts.

Here’s a smart way to structure your accounts:

- Primary business account: Use this for your main income source and its related expenses.

- Dedicated accounts for side income: Create separate accounts for freelance gigs, rental properties, or investment dividends.

- Tax savings account: Regularly transfer a percentage of your earnings from each stream into this account to cover quarterly taxes.

When tax season rolls around, you’ll have clear, organized records for each income source. This setup also makes it easier to combine all the data for a complete financial picture.

Centralize Your Income Data

While keeping accounts separate is great for tracking, you’ll still need a way to see the big picture. A single dashboard that consolidates all your income data can reveal patterns, seasonal trends, and how your income streams interact. This kind of insight helps you make smarter financial decisions.

For instance, Maybe Finance offers a tool that connects to over 10,000 institutions, allowing you to view all your accounts in one place. You’ll still have the detailed tracking from separate accounts, but now you can see how everything fits together.

This approach also helps with cash flow management. For example, you might notice that freelance payments consistently arrive just in time to cover a gap in rental income, or that investment dividends provide a cushion during slower months.

Grant Cardone sums it up well: "When you are deciding on adding another income flow, I want you to consider something in the same industry or a parallel one. This approach allows these multiple flows to feed and fuel one another, which ensures their strength."

Striking a balance between keeping accounts separate and consolidating data is key. Separate accounts help with detailed tracking and record-keeping, while a unified view lets you make strategic decisions to grow and manage your income streams effectively.

Step 4: Review and Adjust Your Income Plan Regularly

Once you've organized your income data, the next step is to turn that structure into a practical strategy. Regularly reviewing your income plan helps you spot trends, address inefficiencies, and make informed decisions. Skipping this step could mean missing out on opportunities to grow your most successful income streams - or wasting time on ones that aren't pulling their weight.

Here’s how to stay on top of your income strategy.

Check Your Income Patterns and Results

Take a close look at your monthly earnings to uncover trends. Tools like Finance's dashboard can make this easier by displaying trends across all your connected accounts in one place. Pay attention to which income streams are thriving, which are slowing down, and which are holding steady. Seasonal patterns are also key - freelance work might peak at certain times of the year, while dividends from investments may follow a quarterly schedule. Understanding these patterns can help you prepare for slow periods and make the most of high-earning months.

Quarterly reviews are an opportunity to dig deeper. Compare your earnings over the past three months to your financial goals. Are you on track to hit your annual targets? Which income streams are outperforming, and which need a second look? This is also a good time to assess whether your current income mix aligns with your risk tolerance and available time.

Experts recommend a comprehensive financial review at least once a year, with quarterly check-ins for specific areas like budgeting, investments, or debt management.

Annual reviews provide the big-picture perspective you need for strategic planning. Look at your year-over-year income growth, identify which streams contributed the most, and evaluate whether your diversification efforts are paying off. Don’t forget to factor in tax implications and adjust your strategy as needed.

Make Smart Changes to Your Income Strategy

Once you’ve identified trends and gaps, it’s time to adjust. Use what you’ve learned to fine-tune your strategy and work toward your long-term financial goals.

Focus on scaling high-performing streams by investing more time, resources, or capital. For instance, if your freelance work consistently brings in strong income with minimal effort, consider raising your rates or taking on more projects.

For underperforming streams, figure out what’s holding them back. Is it temporary market conditions, lack of attention, or something deeper? Sometimes, small tweaks - like improving your marketing or adjusting pricing - can make a big difference.

"Creating a plan that's flexible and then consistently reviewing it can allow you to both stay on track and make adjustments as needed", says Jordan Patrick, CFP at Commas.

If a stream continues to underperform despite your efforts, it may be time to let it go. Freeing up those resources allows you to focus on more profitable opportunities.

Automation can also play a big role in streamlining your strategy. For example, set up automatic transfers from high-performing income streams to savings or investment accounts to ensure you’re making the most of your earnings.

"I personally don't have the willpower to constantly remember what's on my financial plan, so setting up automation, where the stuff is just happening for you without having to think about it, is key to success", notes Jordan Patrick, CFP at Commas.

Life changes - like a new job, a growing family, or unexpected expenses - often call for immediate adjustments. Don’t wait for your next scheduled review; revisit your plan as soon as these changes happen.

Market conditions can also impact your income streams. What works well in a strong economy might need a different approach during tougher times. Staying informed about trends that affect your income sources will help you pivot when necessary.

The goal isn’t to perfect your income plan overnight. Instead, focus on steady improvements through regular reviews and smart adjustments. By staying proactive, you’ll build a financial strategy that’s more resilient and better positioned for growth.

Conclusion: Stay Organized for Better Financial Results

Keeping your income streams organized is a cornerstone of financial success. By implementing a system to identify, track, organize, and review your earnings, you can avoid common pitfalls and set yourself up for growth.

Consider this: 82% of business failures in the U.S. stem from cash flow problems. That statistic alone underscores the importance of proper income tracking. Staying on top of your finances not only helps you dodge potential setbacks but also allows you to seize opportunities others might overlook.

Tools like Maybe Finance simplify this process by consolidating income streams into a single dashboard. With connections to over 10,000 institutions, its AI-driven insights help uncover trends and support smarter decision-making.

"You will have no idea of whether you are making a profit or have a loss… I've had clients who think they are making a profit but, for various reasons, didn't see they were losing money. If they were tracking expenses, they would have noticed", says Maxine Stern, a former business mentor for Chapel Hill-Durham SCORE.

To achieve long-term success, focus on consistent automation, accurate categorization, and regular reviews of your financial data. Reliable data is the foundation for meaningful insights, and it's worth noting that 77% of finance professionals agree that financial planning and analysis provide valuable insights - but only with dependable data.

As outlined earlier, staying organized doesn’t just make tax planning easier - it also empowers you to grow strategically. With a clear view of your finances, you’ll feel more confident in your planning and better equipped to scale your most lucrative income streams. Take control of your financial future and build a foundation for lasting stability.

FAQs

What are the advantages of using Maybe Finance to track income from multiple sources?

Using a platform like Maybe Finance to manage income from multiple sources comes with a range of advantages. It takes the hassle out of tracking by automatically pulling income data from all your accounts into one place. This not only saves time but also reduces the risk of mistakes that can happen with manual tracking. The result? Your financial records stay accurate and up to date without extra effort.

On top of that, Maybe Finance offers real-time insights into your earnings, giving you a clear snapshot of your financial health at any moment. Features like budgeting tools, support for multiple currencies, and AI-driven analytics make it easier to make smart financial decisions and plan ahead. By simplifying income tracking, Maybe Finance helps you stay organized and in control, all with minimal effort on your part.

Why is it important to separate fixed and variable income for better financial planning?

Separating fixed income - like your regular paycheck - from variable income - such as freelance gigs or commissions - is a key step in managing your finances effectively. Fixed income offers consistency, making it easier to handle predictable expenses like rent, utilities, or loan payments. Variable income, however, demands a more adaptable strategy since it can change from month to month.

By clearly identifying these two income types, you can build a financial plan that covers your essential expenses while also setting aside money for savings or investments. This method not only helps you stay on top of your budget but also prepares you for any surprises in your financial situation.

Why should I regularly review my income strategy, and how can I do it effectively?

Regularly taking a closer look at your income strategy plays a key role in keeping your financial goals on track. It allows you to adjust to changes in your income or expenses and explore fresh opportunities for growth. Whether it’s dealing with market fluctuations, inflation, or shifts in your personal circumstances, this habit ensures your financial plan remains effective and supports your long-term stability.

To stay on top of things, make it a point to evaluate your income sources, spending patterns, and savings regularly. If your financial situation or goals shift, tweak your strategy accordingly. Tools like budgeting apps, expense trackers, or financial planning platforms can make this process much easier, giving you a clear and organized view of your finances. By staying consistent with these reviews, you can keep your income strategy aligned with your current needs and future aspirations.

Subscribe to get the latest updates right in your inbox!