How to Track Net Worth for Financial Goals

Josh Pigford

Your net worth is the difference between what you own (assets) and what you owe (liabilities). Tracking it regularly is one of the easiest ways to measure your financial health and progress toward goals like saving for retirement, paying off debt, or buying a home. Here's the quick breakdown:

- Net Worth Formula: Total Assets - Total Liabilities = Net Worth

- Assets: Cash, investments, real estate, vehicles, personal property, and business interests.

- Liabilities: Mortgages, loans, credit card debt, and other outstanding debts.

Why it matters:

- A positive net worth means you're building wealth.

- A negative net worth signals more debt than assets and the need for adjustments.

- Regular tracking helps you see trends, make smarter decisions, and stay motivated.

How to track it:

- List and categorize all assets and liabilities.

- Use tools like spreadsheets for manual tracking or automated apps for real-time updates.

- Review monthly or quarterly to monitor progress.

Start small: Calculate your net worth today and use it as a baseline to set SMART financial goals - specific, measurable, achievable, relevant, and time-bound.

How to Identify and Categorize Assets and Liabilities

To figure out your net worth, you'll need to make a detailed list of all your assets and liabilities. Missing anything could throw off the accuracy of your financial picture. Once you've got everything listed, it's time to organize and categorize them.

Common Asset Categories

Assets can generally be grouped into a few main categories. Let’s break them down:

Liquid assets are the easiest to access and turn into cash. Think checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs).

Investment assets are a bit more complex because their values can change over time. This group includes retirement accounts like 401(k)s and IRAs, brokerage accounts with stocks, bonds, mutual funds, ETFs, and even cryptocurrencies (but remember, crypto is highly volatile).

Real estate assets often make up a big chunk of net worth for many people. Your primary home is the most common example, but don’t forget any vacation homes, rental properties, or even undeveloped land. Use current market estimates to value these properties.

Personal property assets include things like vehicles (cars, motorcycles, boats, RVs) and valuable items such as jewelry, art, collectibles, electronics, and furniture. Everyday items like a couch might not add much to your net worth, but higher-value possessions can make a noticeable difference.

Business interests should also be included if you own all or part of a business. Valuing a business can be tricky, but it’s an essential part of your financial picture. You should also account for the cash value of any life insurance policies you own.

Common Liability Categories

Liabilities are the debts you owe, and they can be grouped into several categories:

Housing debt is often the largest liability for most people. This includes your primary mortgage, any second mortgages, home equity lines of credit (HELOCs), and mortgages on investment or vacation properties.

Consumer debt includes credit card balances, personal loans, and store credit accounts. These often come with higher interest rates, so be sure to list the current balance, not the credit limit.

Vehicle loans cover financing for cars, motorcycles, boats, and other vehicles.

Educational debt includes federal and private student loans, as well as Parent PLUS loans or loans you’ve co-signed for others.

Other liabilities might include money borrowed from family or friends, unpaid taxes, or any other outstanding debts.

How to Value Assets and Liabilities

Getting accurate valuations is key to tracking your net worth effectively.

For liquid assets, use your most recent bank statements to get the current balances.

Investment assets should be valued using the latest market prices. Your brokerage or retirement account statements will usually provide updated values. Since these values can change frequently, try to be consistent about when you update them.

Real estate assets require a bit more effort. Online tools like Zillow or Redfin can give you a general idea, but for a more precise number, look at recent sales of similar properties in your area - or consider a professional appraisal if you’re making major financial decisions.

Use resources like Kelley Blue Book or Edmunds to get the current value of vehicles and recreational assets. You’ll need details like the year, make, model, mileage, and condition.

Personal property can be harder to pin down. For everyday items, use conservative estimates. For high-value items like jewelry or art, a professional appraisal might be worth considering.

Liabilities are usually straightforward. Check your latest statements for mortgages, car loans, student loans, and other debts to find the current balances. For credit cards, use the most recent balance, but remember this number can change frequently.

Here’s an example of how it all comes together:

Assets – primary residence: $250,000; investments: $100,000; personal property: $25,000.

Liabilities – mortgage: $100,000; car loan: $10,000.

Net worth = ($250,000 + $100,000 + $25,000) - ($100,000 + $10,000) = $265,000.

How often you update these values depends on the type of asset. Liquid assets and investments are best updated monthly or quarterly, while real estate and vehicle values can be checked annually - unless there’s a significant market shift.

Once everything is categorized and valued, you’ll have a clear financial snapshot and can start tracking your net worth over time.

How to Calculate and Track Net Worth

The Net Worth Formula

To figure out your net worth, subtract your liabilities from your assets: Net Worth = Total Assets - Total Liabilities. For example, if your assets add up to $375,000 and your liabilities total $110,000, your net worth is $265,000.

A positive net worth shows that your assets outweigh your liabilities - a sign of solid financial health. On the other hand, a negative net worth means you owe more than you own. This is not unusual for people just starting out, especially those with student loans or hefty mortgages.

Once you understand the formula, tracking changes over time becomes a powerful way to measure your financial growth.

Tracking Net Worth Over Time

Calculating your net worth once gives you a quick snapshot of where you stand financially. But the real value comes from tracking it over time. Regular monitoring helps you see how your decisions - like saving, spending, or investing - impact your overall financial picture and whether adjustments are needed.

For example, even if the value of your home decreases, growth in your investments and savings can still increase your net worth. Imagine starting at $265,000 and watching it climb to $300,000 over five years. This kind of tracking keeps you motivated to save, manage spending, and tweak your investment strategy. Reviewing your portfolio quarterly is a smart way to stay on top of your progress and ensure your financial goals remain aligned with your actions.

By consistently tracking your net worth, you gain insight into your financial trends and can make more informed decisions about your future.

Manual vs. Automated Tracking

Choosing the right method to track your net worth depends on your financial situation and personal preferences. You can go with a manual approach, like spreadsheets, or opt for automated tools that sync with your accounts.

Manual tracking involves using a spreadsheet to record your assets and liabilities. It’s a hands-on method that gives you total control over the process and an offline record. However, it can be time-consuming and prone to errors, especially as your finances become more complex.

Automated tracking, on the other hand, connects to your financial accounts to pull in real-time data. These tools automatically update balances for your investments, loans, and other accounts, often presenting the information in easy-to-read charts and graphs. While convenient, automated tools often come with subscription costs and may limit how much you can customize the data.

Here’s a quick comparison:

| Feature | Manual Tracking (Spreadsheets) | Automated Tracking |

|---|---|---|

| Data Entry | Manual input required | Automatic syncing |

| Updates | Needs manual updates | Real-time updates |

| Customization | Full control | Limited by software |

| Cost | Free (basic tools) | Often requires a subscription |

| Effort Required | High maintenance | Minimal effort |

| Error Risk | Higher (due to manual input) | Lower (automated calculations) |

The right choice depends on your needs. If you prefer full control and have a relatively simple financial setup, spreadsheets might be your best bet. But if you juggle multiple accounts and want a low-maintenance solution, an automated tool could be worth the investment.

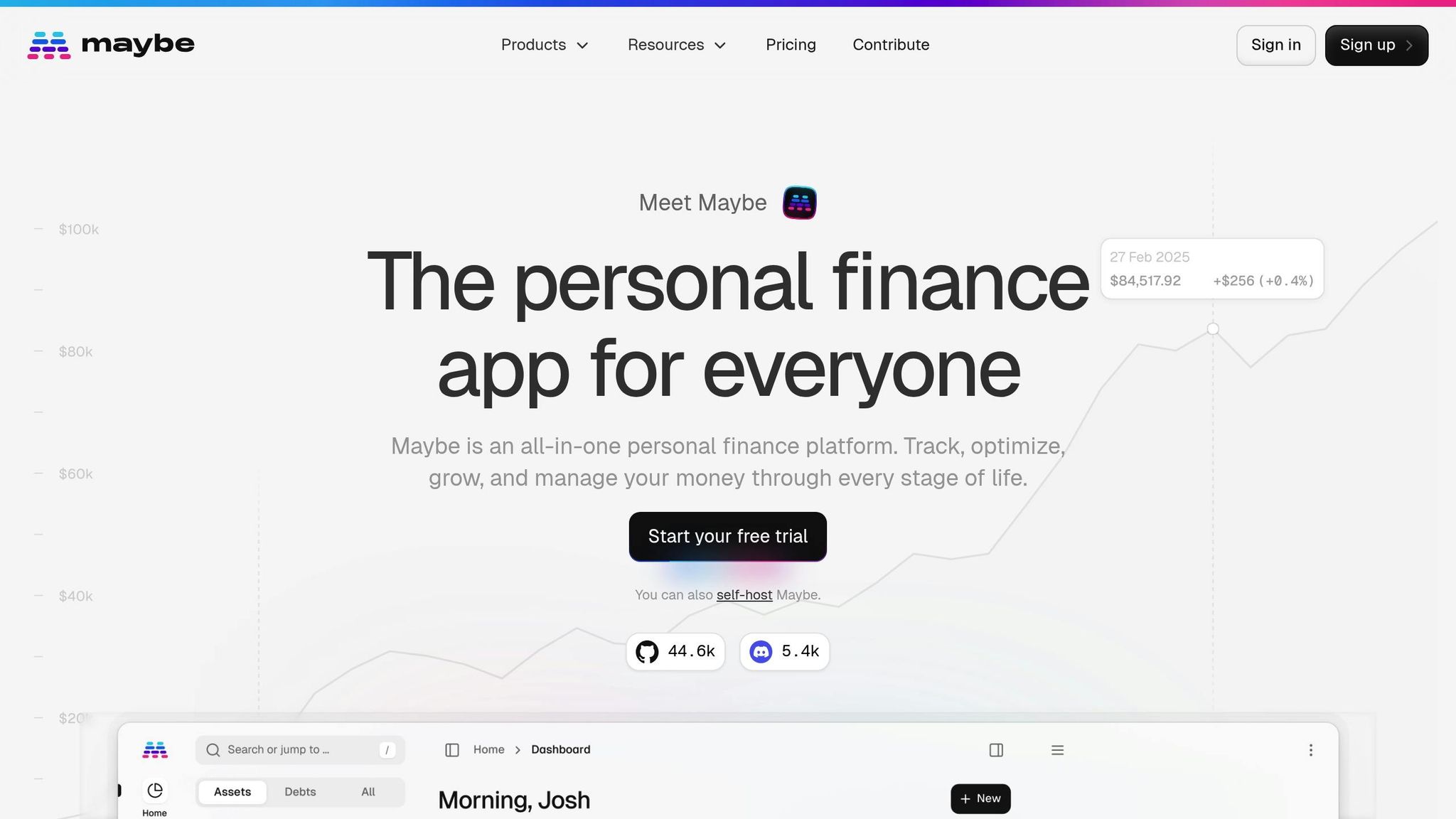

For example, Maybe Finance offers an automated platform that connects to over 10,000 financial institutions. It provides real-time updates on your assets and debts, supports multiple currencies, and even uses AI to analyze your financial trends. Plus, for those who want automation but still value data control, Maybe Finance lets you self-host the platform, blending convenience with privacy.

How to Use Net Worth to Set Financial Goals

Once you've started tracking your net worth, the next step is using that information to shape and refine your financial goals. Think of your net worth as a financial compass - it helps you set realistic goals and measure your progress along the way.

Setting SMART Financial Goals

The SMART framework is a great way to create clear, actionable goals tied to your net worth. Instead of vague aspirations, focus on specific objectives that align with your financial situation.

For example, let’s say your net worth is $150,000. A SMART goal could look like this: "Grow my net worth to $200,000 within three years by contributing $1,200 monthly to my investment accounts and paying off $15,000 in student loans." This goal is specific, measurable, achievable, relevant, and time-bound.

If you're dealing with a negative net worth - say, $80,000 in assets but $120,000 in liabilities - your first priority might be tackling high-interest debt before focusing on wealth-building strategies.

"Net worth is a reflection of the financial decisions that you have made. You can see if you are investing if your assets are growing, or if your net worth is declining because you're spending too much."

– Alissa Todd, personal chief financial officer and wealth advisor at The Wealth Consulting Group

When setting goals, make sure to address both short-term and long-term priorities. Short-term goals might include paying off a credit card or building an emergency fund, while long-term objectives could center on retirement savings or achieving financial independence.

Adjusting Goals Based on Net Worth Changes

Financial goals aren't static - they should evolve as your net worth changes. Regular tracking can help you identify trends and decide when it’s time to adjust your strategy.

If your net worth is steadily increasing, you might feel confident enough to set more ambitious goals. For instance, if you originally planned to reach $500,000 by age 40 but find yourself ahead of schedule, you could aim higher or explore new investment opportunities.

On the flip side, a declining or stagnant net worth signals the need for a closer look. Are your expenses higher than expected? Do your investments need rebalancing? Monitoring your net worth regularly allows you to spot these issues early and make necessary adjustments.

"Focus on the trend of your net worth. Are you noticing over time that your assets are increasing and your debts decreasing? That means you're headed in the right direction."

– Alissa Todd, personal chief financial officer and wealth advisor at The Wealth Consulting Group

By staying flexible, you ensure that your financial goals remain aligned with your current circumstances.

Regular Goal Reviews

Just as you track your net worth regularly, reviewing your financial goals should be an ongoing practice. Experts suggest revisiting your goals at least once or twice a year, ideally when you update your net worth. This helps you stay on track and adjust to changes in your financial or personal life.

During these reviews, ask yourself important questions: Are your assets growing as planned? Are you reducing debt as expected? Have there been any major changes in your income or expenses? The answers can guide any necessary tweaks to your goals.

"Your financial goals aren't set in stone. Life changes - like marriage, having children, or switching careers - can impact your financial priorities."

– Daniel Milks, founder of Woodmark Wealth Management

Remember, progress isn’t always smooth. Market dips might temporarily lower your investments, or unexpected expenses could slow debt repayment. What matters is understanding the reasons behind these shifts.

"It takes time to see an actual change in net worth. The important thing is to understand the why behind the change. Do I need to investigate this further? Do I need to change any of my financial habits so that we can correct any financial behaviors? Or does it show what you're doing well and you're on track?"

– Alissa Todd, personal chief financial officer and wealth advisor at The Wealth Consulting Group

Use these reviews to celebrate milestones and recognize your achievements. When you hit a major target, let that success inspire your next goal.

"Use your net worth as a tool to measure progress toward what truly matters to you, whether that's financial independence, buying a home, or retiring comfortably. Your life goals, not an arbitrary number, should guide your financial decisions."

– Kathleen Coxwell, Boldin

How Maybe Finance Simplifies Net Worth Tracking

Keeping tabs on your net worth manually can be a hassle, not to mention prone to mistakes. Maybe Finance, an open-source personal finance platform, takes the stress out of net worth tracking by offering a precise and flexible system that grows with your financial needs. Known for its focus on 100% calculation accuracy, this platform acts as a reliable personal finance hub. Let’s dive into its standout features, customization options, and privacy-focused self-hosting capabilities that make managing your net worth easier and more secure.

Key Features for Net Worth Tracking

Maybe Finance connects with more than 10,000 financial institutions, making it incredibly easy to track your finances across accounts without the headache of manual updates. It supports multi-currency tracking with up to four decimal places using ISO codes, ensuring every penny is accounted for, no matter where it’s stored. This level of precision provides a solid foundation for making informed decisions and working toward SMART financial goals.

The platform also includes a flexible rules engine that automatically categorizes your transactions. You can search your transaction history, add notes, and even set up automated classification rules to save time. With AI-powered insights, you can analyze trends in your income and expenses, offering a clear and real-time picture of your financial health.

Not sure if the platform is for you? A demo user feature lets you test the system with sample data before connecting your actual accounts. This way, you can feel confident in the platform’s accuracy before diving in.

Customizing and Automating Financial Tracking

Maybe Finance adapts to your priorities with customizable apps that can be enabled or disabled depending on your focus - whether it’s paying down debt, building wealth, or planning for retirement. These tools are designed to evolve with your financial goals.

The platform’s reports go beyond just net worth, offering insights into credit scores and detailed credit reports. You can schedule these reports to run automatically on a monthly, quarterly, or custom basis, eliminating the need for manual tracking. Visual tools like charts and graphs make it easy to spot trends and track your progress over time, presenting your financial data in a way that’s far more approachable than traditional spreadsheets.

While automation is a major part of Maybe Finance, it doesn’t come at the expense of control. Your data remains yours to manage.

Privacy and Control with Self-Hosting

If data privacy is a top concern, Maybe Finance has you covered with its self-hosting option. This feature ensures your financial data stays under your control, removing the risks associated with third-party access. You can implement your own security measures, such as custom firewalls and encryption protocols, to meet your specific privacy needs.

For those who’d rather not deal with server management, managed hosting options through services like Elestio are available. These services handle everything from installation and security to backups and updates, offering convenience while still prioritizing privacy.

Because Maybe Finance is open-source, it’s highly customizable. Whether you need specific reports or unique calculation methods, the platform can be tailored to suit your exact financial tracking needs. This flexibility ensures it remains a tool that works for you, no matter how your financial situation evolves.

Conclusion

By applying the methods and tools we've covered, consistently tracking your net worth can become one of the most impactful financial habits you adopt. It provides a clear, detailed picture of your overall financial health - far more comprehensive than just focusing on your income or savings. This habit empowers you to make smarter decisions, identify trends early, and adjust your financial strategies before minor issues turn into major setbacks.

People who actively monitor their finances often achieve far better results than those who don’t. Keeping tabs on your net worth regularly gives you the insights needed to tackle debt, build an emergency fund, or grow your investments with purpose.

Consistency is the secret sauce here. Updating your net worth on a monthly basis ensures you have the information needed to make informed financial moves.

"Focus on the trend of your net worth. Are you noticing over time that your assets are increasing and your debts decreasing? That means you're headed in the right direction." – Alissa Todd

The good news? This doesn’t have to be complicated. Tools like Maybe Finance can streamline the process by connecting to over 10,000 financial institutions, offering real-time updates, and even providing AI-driven insights. With features like multi-currency support and customizable tracking, managing your net worth has never been more accessible.

Ultimately, your net worth journey is personal. The most meaningful comparison is how you're progressing compared to your past self. By building this habit and pairing it with realistic, measurable goals, you’re setting yourself up for long-term financial success - one step at a time.

FAQs

How often should I update my net worth to stay on track with my financial goals?

To keep track of your financial progress, it's wise to calculate your net worth at least once a year. If you want a clearer picture and to stay updated on any changes, updating it quarterly can be even more helpful. Regular check-ins allow you to understand your financial health better, identify patterns, and adjust your goals as necessary.

Pick a schedule that fits your routine, but remember - sticking to it consistently is crucial for gaining valuable insights into your finances.

What mistakes should I avoid when calculating and organizing my assets and liabilities?

When assessing your assets and liabilities, steer clear of these common mistakes to get a clear and accurate view of your net worth:

- Mixing up asset and liability classifications: Confusing current and non-current assets or mislabeling liabilities can throw off your entire financial snapshot.

- Neglecting regular account reconciliations: If you don't compare your records to actual bank balances, errors can creep into your calculations.

- Overloading your categories: An overly detailed or inconsistent chart of accounts can lead to unnecessary confusion and make tracking more difficult.

To maintain accuracy, take time to review your financial statements regularly and keep your records organized. Clear, up-to-date information is essential for making smarter financial choices and staying on top of your goals.

How can tracking my net worth help me set and adjust financial goals?

Your net worth - essentially the difference between what you own (your assets) and what you owe (your liabilities) - is a straightforward way to gauge your financial well-being. Keeping tabs on it regularly can help you track progress, identify patterns, and fine-tune your financial plans.

For instance, if your net worth is growing, it could mean you're moving closer to milestones like buying a home or building a solid retirement fund. But if it’s stagnant or shrinking, it might be time to reassess your spending habits, savings approach, or investment decisions. Reviewing your net worth consistently helps ensure your financial goals remain practical and adjust as your life and priorities evolve.

To make this easier, tools like Maybe Finance offer a one-stop solution to track your accounts, visualize your assets and debts, and manage your money with ease.

Subscribe to get the latest updates right in your inbox!