Retirement Software Comparison: Top Features

Josh Pigford

Planning for retirement can be tricky, especially with rising healthcare costs and an aging population. Retirement planning software simplifies this process by analyzing your finances, setting goals, and creating strategies. Here’s what you need to know:

- Top Tools Reviewed: Boldin, MaxiFi, RightCapital, Maybe Finance.

- Key Features: Budget tracking, income projections, tax strategies, Social Security planning, and healthcare cost estimates.

- Standout Features:

- Boldin: Detailed scenario planning and advanced tax tools.

- MaxiFi: Focuses on steady living standards and tax efficiency.

- RightCapital: Combines intuitive design with secure account aggregation.

- Maybe Finance: Open-source transparency and real-time financial tracking.

Quick Comparison

| Platform | Strengths | Limitations |

|---|---|---|

| Boldin | Scenario planning, strong security | Limited account integration |

| MaxiFi | Tax optimization, steady income focus | Complex for beginners |

| RightCapital | Easy account aggregation, visual tools | Higher cost for advanced features |

| Maybe Finance | Open-source, affordable pricing | Evolving retirement modeling features |

The right tool depends on your needs - whether it’s transparency, tax planning, or detailed forecasting. Keep reading for a deeper dive into each platform's features.

1. Boldin

Boldin simplifies complex retirement planning, offering easy-to-navigate tools for individuals and advisors alike. Let's dive into its standout features, from dynamic retirement modeling to advanced security measures.

Retirement Modeling

Boldin's retirement modeling tools focus on adaptability and scenario planning. With the ability to create and compare up to 10 scenarios - ranging from optimistic to pessimistic forecasts - users can explore various paths, like retiring early or moving to a more affordable location, using the platform's intuitive Scenario Builder. It also supports modeling for multiple income sources, including wages, Social Security, pensions, and annuities, across different timeframes. Real estate planning is another highlight, allowing users to factor in home sales, relocations, and other property-related changes.

The platform offers flexibility in managing withdrawals, letting users align them with their actual spending needs, fixed percentages, or maximum spending evaluations. Additionally, users can customize the order of account withdrawals. Boldin also takes care of required minimum distributions (RMDs) for retirement and inherited IRA accounts, ensuring compliance with federal guidelines.

According to Boldin's data, 70% of its users see improved net worth, and those who engage in detailed planning achieve financial outcomes that are 2.7 times better than individuals who skip planning altogether.

Tax Optimization

Boldin provides tools to fine-tune tax strategies over a lifetime. Its Roth Conversion Explorer helps users evaluate different conversion approaches, whether the goal is to maximize an estate, minimize taxes, or stay within specific tax thresholds like IRMAA (Income-Related Monthly Adjustment Amount) limits.

The platform models various tax scenarios, including federal and state income taxes, capital gains taxes, Social Security benefit taxes, and FICA taxes. This comprehensive tax analysis ensures users grasp the full financial impact of their retirement plans, tailored to different states and income levels.

By integrating tax planning directly into the overall retirement strategy, Boldin eliminates the need for tedious manual calculations often required by simpler tools.

Security and Data Control

Boldin doesn’t just focus on planning - it also prioritizes top-tier security. The platform meets SOC2 Type 1 and 2 standards, employs bank-grade encryption, and operates in 24/7 secured data centers with biometric checkpoints and video surveillance.

It holds certifications like TrustArc, complies with GDPR and CCPA regulations, and offers Multi-Factor Authentication (2FA) for enhanced user protection. Boldin partners with leading financial tech providers that undergo regular security audits to maintain high standards.

User privacy is a core principle. Boldin doesn’t sell user data or require sensitive information like Social Security numbers, real names, or account numbers. It also avoids storing credit card details. For any security concerns, users can reach out through their dedicated reporting system at [email protected].

2. MaxiFi

MaxiFi approaches retirement planning with a unique perspective, focusing on maintaining a steady standard of living throughout your life rather than simply aiming to accumulate wealth. It uses the Life-Cycle Hypothesis of saving and consumption to guide users in creating a balanced financial future.

Retirement Modeling

At the heart of MaxiFi is a powerful optimization engine that simulates thousands of scenarios to determine your maximum sustainable living standard. This tool combines your earnings, assets, retirement accounts, taxes, and fixed expenses into a clear, actionable plan for annual spending.

MaxiFi offers two planning methods:

- A deterministic plan that uses conservative assumptions to create a "safety-first" approach.

- A statistical plan that explores a range of possible outcomes, giving you a broader view of your financial future.

The platform's Living Standard Monte Carlo simulations allow you to see how different investment strategies and spending habits could affect your standard of living over time. You can also model various scenarios by tweaking factors like maximum ages, inflation rates, Social Security benefits, tax rates, and more. This flexibility helps you map out income, spending, savings, and insurance needs while adapting plans as needed.

To keep projections realistic, MaxiFi updates its inflation and return assumptions every six months, drawing data from the long-term TIPS market. These tools integrate seamlessly with its tax strategies, helping you maximize your retirement income.

Tax Optimization

MaxiFi goes beyond basic planning by offering detailed tax optimization tools that refine your financial strategy. It calculates Federal, State, and FICA taxes to identify the most tax-efficient withdrawal strategies and the optimal timing for tapping into retirement accounts. By balancing the use of Roth and non-Roth accounts, MaxiFi can help users achieve significant financial benefits.

"MaxiFi can raise your lifetime spending by tens to hundreds of thousands of dollars by optimizing Social Security, lowering lifetime taxes, and more." - MaxiFi Planner

The Roth Conversion Optimizer is one of MaxiFi's standout features. It factors in key elements like changes in current and future taxes, required minimum distributions from non-Roth accounts, Social Security benefit taxation, Medicare Part B IRMAA premiums, and cash-flow needs.

For example, John, a 65-year-old retiree in Tennessee with $1.25 million in regular assets and $1.25 million in a traditional IRA, used MaxiFi's Roth Conversion Optimizer. The tool identified $183,387 in lifetime tax savings. By converting $1,095,426 of his IRA over five years, he saved $139,902 in federal taxes and $43,484 in IRMAA taxes. This allowed John to increase his spending by $2,623 per year until age 70 and by $11,617 annually after that.

MaxiFi also helps users determine the best Social Security filing strategy, showing how different filing dates can influence overall lifetime spending.

Security and Data Control

MaxiFi takes user privacy and data security seriously. It employs industry-standard 128-bit encryption for communication and AES-256 encryption for stored data.

"We view customer data as our customers' private property and take all reasonable steps to maintain its privacy, while only collecting information we absolutely need." - MaxiFi Planner

For added security, the platform offers optional Two-Factor Authentication (TFA), requiring a code sent to your mobile device during login. Data is stored in secure data centers equipped with advanced security protocols, and MaxiFi regularly conducts third-party reviews and security tests on its systems.

MaxiFi also stands out for its strict privacy policies. It does not sell financial products, share user data with third parties, or access customer information without explicit consent for support purposes. Users can remain anonymous by using the software without providing real names, Social Security numbers, or account details, reducing the exposure of personal information while still benefiting from comprehensive financial planning tools.

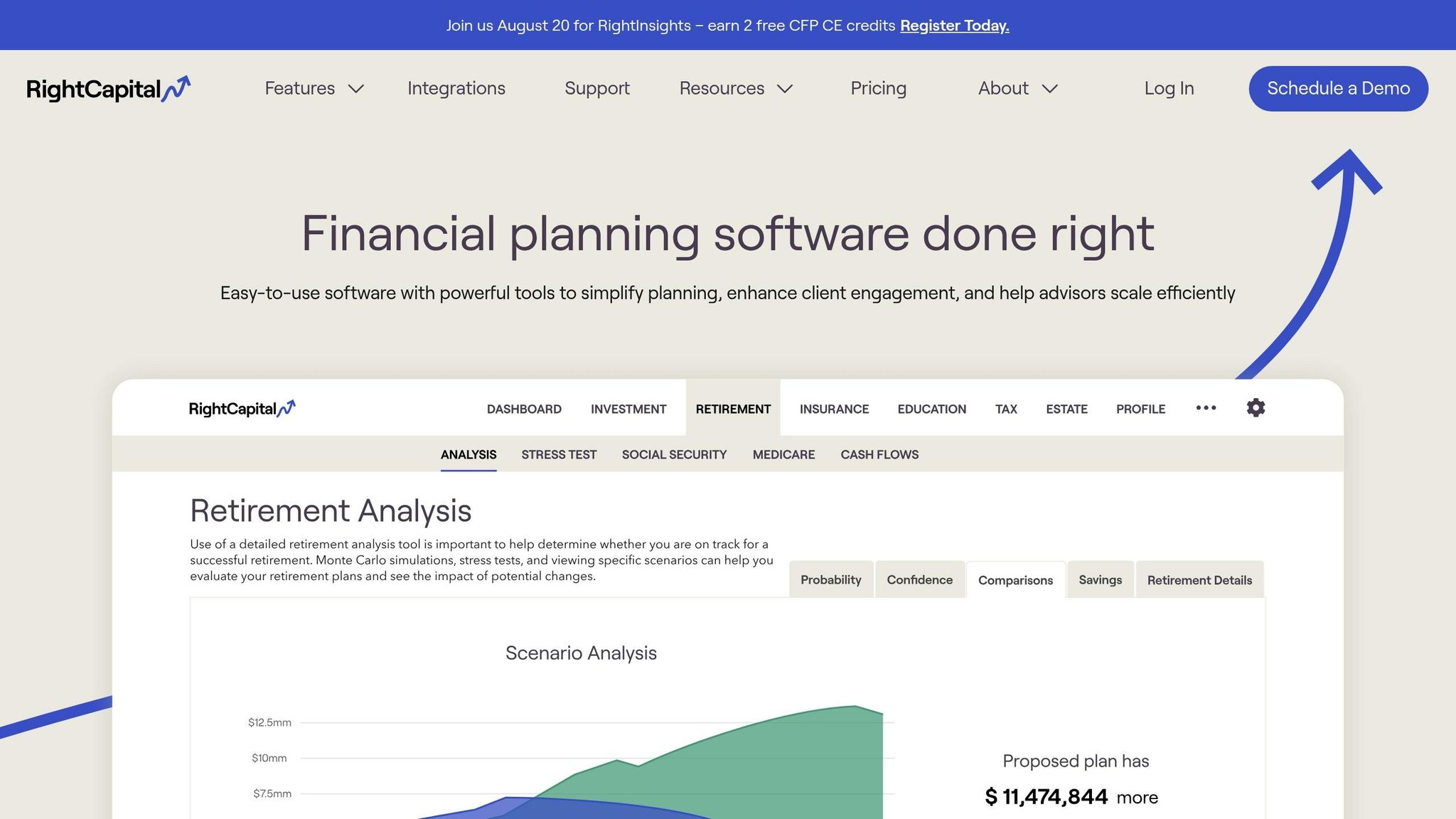

3. RightCapital

RightCapital has earned top honors in The Kitces Report's 2024 Financial Planner Productivity Study and the 2023 AdvisorTech Study. This platform combines advanced modeling features with an intuitive interface, making it a go-to solution for creating detailed retirement plans.

Account Aggregation

RightCapital partners with Envestnet | Yodlee to provide secure account aggregation. With read-only access, it pulls data from linked accounts without storing sensitive banking credentials. This system creates a unified view of assets, liabilities, and cash flow by automatically syncing real-time account data. As balances change, retirement projections automatically update, ensuring plans stay current and accurate.

Retirement Modeling

At the heart of RightCapital is its Retirement Analysis module, which helps users craft and compare strategies. Starting with a "Current plan", users can explore adjustments using "Action Items" to create a "Proposed plan." Monte Carlo simulations then evaluate the success probability and projected median asset values for each scenario. Advisors can save multiple proposed plans to explore various outcomes side by side.

"RightCapital is a comprehensive financial planning solution including both accumulation and decumulation." - Shuang Chen, RightCapital CEO

The module is divided into five tabs: Probability, Confidence, Comparisons, Savings, and Retirement Details. The Comparisons tab highlights differences in assets and taxes between plans, while the Savings tab focuses on the accumulation phase. Meanwhile, the Retirement Details tab dives into the decumulation phase, showing income, withdrawals, and expenses during retirement.

RightCapital also supports flexible spending strategies. Advisors can set portfolio value thresholds that adjust spending based on market performance, allowing for adaptable income strategies.

"Few retirement plans integrate extensive tax planning with spending guardrails like RightCapital." - Bjorn Amundson, certified financial planner and a principal advisor of Quarry Hill Advisors

Tax Optimization

RightCapital's tax planning tools, including the Tax Strategies module and Tax Analyzer, are designed to uncover opportunities for tax savings. Users can upload client tax returns directly into the system, where the platform scans, removes sensitive information, and identifies missing data. Advisors can propose tax changes and instantly see their impact on federal taxes, deductions, and credits.

The platform is especially effective for illustrating strategies like Roth conversions and tax-efficient withdrawals. For instance, financial advisor Derek Mazzarella demonstrated $116,000 in potential savings using a tax-efficient distribution strategy, helping him secure a new client.

"Easily connect tax return data to clients' financial plans, uncover savings, and clearly demonstrate the impact of strategies like Roth conversions and tax-efficient withdrawals." - RightCapital

These advanced tax tools are included in RightCapital's Premium and Platinum subscriptions, ensuring seamless integration with broader retirement strategies.

Security and Data Control

RightCapital places a strong emphasis on data security. The platform uses Amazon's secure data centers with AES-256 encryption to protect information in transit and at rest. Its HTTPS implementation has earned an A+ rating from independent Qualys SSL Labs.

"We know that the security of your clients' data is of utmost importance to your business, so we've made it ours too. Rest easy knowing we've developed our software with best-in-class security practices." - RightCapital

Security measures include two-step verification, SSL encryption, and compliance with multiple standards such as ISO 27001, SOC 2, and PCI DSS Level 1. Payment processing is handled through Stripe, a PCI-compliant processor, ensuring encrypted transactions. The platform also performs daily data backups, retaining at least 30 days of backup data and replicating it across multiple locations for disaster recovery. RightCapital's staff does not access user data unless explicitly requested for support or required by law, ensuring privacy remains a top priority.

4. Maybe Finance

Maybe Finance offers a fresh take on retirement planning by merging detailed financial tracking with open-source transparency. This all-in-one platform gives users a complete view of their finances, making retirement planning more precise and accessible.

Account Aggregation

Maybe Finance integrates with over 10,000 financial institutions, letting users link everything from checking and savings accounts to credit cards, loans, investments, and even cryptocurrency holdings - all in one streamlined dashboard. It uses Plaid as its bank data provider, ensuring financial data is protected with AES-256 and TLS encryption.

For accounts that don’t connect automatically, users can manually add data or upload CSV files. The platform also features a customizable rules engine for transaction categorization, allowing users to organize income and expenses in a way that aligns with their retirement goals.

Balances across all linked accounts update in real-time, providing an accurate snapshot of net worth, spending trends, and income patterns. This seamless integration ensures users have reliable data to make informed retirement decisions.

Retirement Modeling

Building on its comprehensive account aggregation, Maybe Finance offers a retirement modeling tool designed to help users plan for financial independence. This feature allows users to set specific retirement goals and explore various scenarios to understand the steps needed to achieve them.

The platform lets users account for major life events - like buying a home, changing careers, or expanding their family - and calculates how these factors might influence their financial trajectory. By analyzing current savings rates and spending habits, it projects a clear path toward reaching retirement goals.

Maybe Finance keeps things simple, avoiding complicated financial jargon. Instead, it presents retirement scenarios in easy-to-understand terms, making it an approachable tool for anyone looking to plan their financial future.

Security and Data Control

Security and transparency are at the heart of Maybe Finance. The platform’s open-source design allows anyone to audit the codebase, ensuring users know exactly how their financial data is managed.

"At Maybe, we place a high priority on making the app secure and transparent. Our codebase is fully open-source and is auditable by anyone." - Zach Gollwitzer, Maybe Finance

Users can choose between two hosting options: a managed mode where Maybe Finance handles servers and databases, or a self-hosted mode for those who want full control over their data. For managed hosting, Maybe Finance relies on Render, which meets SOC 2 Type II compliance standards, and Cloudflare for network security.

To protect user data, Maybe Finance uses encryption for data at rest and HTTPS for data in transit. Two-factor authentication is available and strongly recommended for all users. Access to production data is tightly restricted, with only essential customer support staff having limited access to assist users.

The platform also offers optional AI-powered financial insights. However, this feature is opt-in only, and the AI is restricted to analyzing transaction context and financial data. It never accesses personal details such as names, email addresses, or account numbers, ensuring user privacy remains intact.

Strengths and Weaknesses

Every platform comes with its own set of pros and cons. Knowing these can help you pick the software that best suits your financial planning goals.

| Platform | Key Strengths | Main Limitations |

|---|---|---|

| Boldin | SOC2 Type 1 and 2 compliance, TrustArc certification, GDPR and CCPA compliance, 256‑bit encryption, multi‑factor authentication, and detailed "what‑if" scenarios | Limited account integration compared to newer platforms |

| Maybe Finance | Open‑source transparency with self‑hosting options, integration with over 10,000 financial institutions via Plaid, and AES‑256 encryption with optional AI-powered insights | Newer platform with developing retirement modeling features |

These distinctions provide a foundation for understanding how each platform’s design impacts its effectiveness in financial planning.

Security and Data Protection

Security remains a top priority for financial planning tools. Maybe Finance stands out with its open‑source codebase, letting users review its security protocols. It also offers managed hosting through SOC 2 Type II compliant providers or a self‑hosting option, giving users more control over their data.

Account Integration

When it comes to connecting with financial institutions, Maybe Finance leads the way with Plaid integration, offering access to over 10,000 institutions. Boldin, on the other hand, has more limited integration options, which might be a drawback for users with diverse financial accounts.

Retirement Calculation Complexity

Retirement planning tools vary in how they handle complex scenarios. While some platforms dive deep into intricate tax calculations and Social Security optimization, this level of detail can be overwhelming for users seeking simplicity. Both Boldin and Maybe Finance aim to strike a balance, delivering clear and straightforward retirement estimates without unnecessary complications.

Cost Structure

Maybe Finance offers a simple pricing model: $9 per month or $90 annually. This transparency makes it an affordable choice compared to some alternatives that charge higher annual fees or one-time payments. Predictable pricing can be a significant factor for users looking for budget-friendly options.

User Experience

Advanced financial tools often come with a learning curve, which can discourage individual users. With fewer than 44% of Americans having fully assessed their retirement needs, user-friendly platforms are critical. Both Boldin and Maybe Finance focus on accessibility, making it easier for users to stay engaged with their financial planning.

Transparency and Data Ownership

Maybe Finance sets itself apart with its open‑source approach, allowing users to verify security measures directly. The self‑hosting option ensures complete control over financial data, a crucial feature in an era where billions of records have been compromised. This level of clarity gives users confidence in choosing tools that align with their personal goals.

Engagement and Effectiveness

Studies reveal that individuals who actively plan their finances are 2.7 times more likely to succeed and 54% more likely to feel financially secure. Ultimately, the best software is the one you’ll use consistently, tailoring it to meet your unique needs and goals.

Conclusion

Picking the right retirement software comes down to your personal financial goals and how you like to plan. Each platform has its own strengths, tailored to different needs.

Maybe Finance is a great option for users who value transparency and control over their data. Priced at $9 per month or $90 annually, it connects with over 10,000 financial institutions through Plaid and offers an open-source design with self-hosting options. This makes it a solid choice for tech-savvy individuals who want full control over their financial information. While its retirement modeling tools are still evolving, it provides a strong foundation with its comprehensive financial tracking features.

Boldin, on the other hand, shines in security and compliance. With SOC2 Type 1 and Type 2 certifications and advanced "what-if" scenario planning, it’s ideal for users who need high-level security and detailed forecasting. However, its limited account integration might be a drawback for those managing a wide variety of accounts.

Other platforms like MaxiFi and RightCapital bring their own advantages. MaxiFi focuses on sustainable planning with a strong emphasis on tax efficiency, while RightCapital offers detailed simulations and secure account aggregation to help users stay on top of their financial goals.

The key is to choose software that fits your approach to planning. If you want hands-on control and transparency, Maybe Finance is worth exploring. For those who prioritize enterprise-grade security and in-depth scenario analysis, Boldin is a strong contender.

Whichever you choose, the right tools - combined with consistent use - can help you stay engaged and on track. Look for features like account connectivity, robust security, analytical tools, and pricing that align with your needs to make the most of your retirement planning.

FAQs

How does Maybe Finance protect my financial data and ensure my privacy?

How Maybe Finance Protects Your Financial Data

Maybe Finance takes your financial data's security and privacy seriously, implementing strong measures to keep it safe. As an open-source platform, its code is fully transparent, meaning anyone can review it. This openness builds trust and ensures the platform remains accountable.

Your privacy is a top priority - Maybe Finance is designed to never sell or share your financial information with third parties. For those seeking even greater control, the platform offers the option to self-host. By hosting Maybe Finance on your own infrastructure, you can manage your data securely and independently.

These thoughtful measures combine to protect your sensitive financial information from unauthorized access, keeping your privacy intact at all times.

What makes Maybe Finance a great choice for retirement planning?

Maybe Finance is a standout option for retirement planning, offering a clear picture of your finances alongside smart budgeting tools. The platform automatically organizes your expenses and delivers AI-driven suggestions tailored to your long-term retirement objectives.

What sets Maybe Finance apart is its open-source design, giving users the freedom to customize and maintain full control over their financial data. This level of transparency and flexibility makes it an excellent fit for crafting personalized retirement strategies. With features like multi-currency support and the ability to track accounts from over 10,000 financial institutions, Maybe Finance keeps you organized and focused on reaching your retirement goals.

How does Maybe Finance's open-source design give me more control over my financial planning?

Maybe Finance's open-source platform puts you in charge of your financial planning like never before. With the option to self-host, you can manage your data securely and on your own terms, giving you complete control over your privacy. Plus, being open-source means you can dive into the code, understand how it works, and even tweak it to fit your specific financial goals.

This approach provides a tailored, transparent, and secure way to track and organize your finances, all while keeping you in the driver’s seat.

Subscribe to get the latest updates right in your inbox!