10 Ways to Track Spending Across Multiple Currencies

Managing expenses in multiple currencies can be tricky. Exchange rate fluctuations, hidden transaction fees, and compliance rules often make it harder to stay on top of your finances. But the right tools can simplify the process. Here's a quick overview of 10 tools designed to help you track spending across currencies:

- Maybe Finance: Real-time exchange tracking, automated conversions, and account integration for $9/month.

- Revolut: Supports spending in 150+ currencies with real-time analytics and fraud prevention features.

- Wise: Mid-market rates, 40+ currencies, and fast transfers for personal and business use.

- YNAB: Zero-based budgeting with tools for currency separation and travel expense tracking.

- Personal Capital: Unified dashboard for all accounts, offering spending insights and investment monitoring.

- Monzo: Real-time notifications, fee-free withdrawals, and live exchange rates for personal and business accounts.

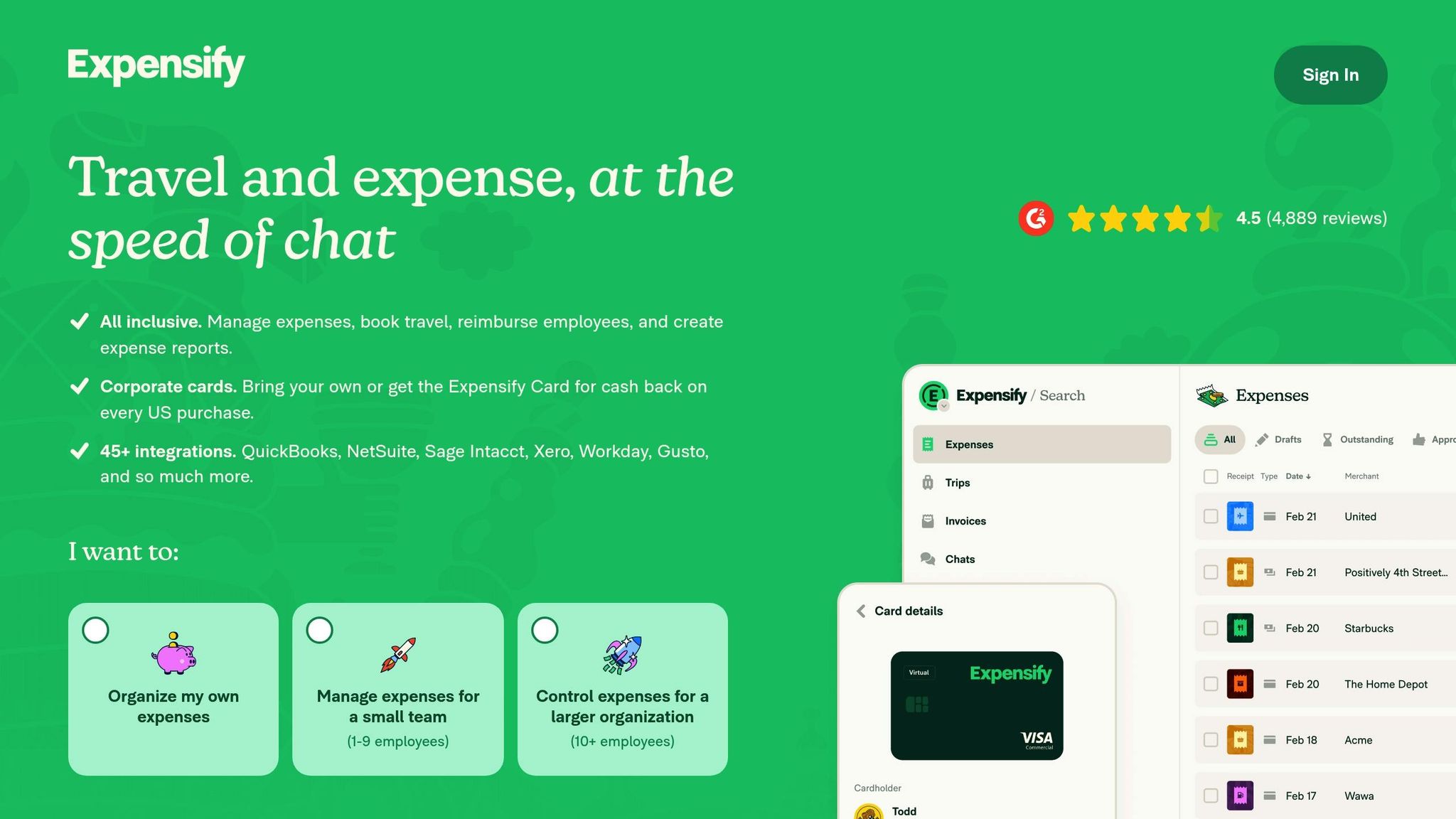

- Expensify: Automatic currency conversions, global reimbursements, and integration with 45+ platforms.

- Mint: Links 17,000+ financial institutions for real-time tracking and spending analysis.

- Xero: Multi-currency invoicing, real-time exchange rates, and consolidated reporting.

- QuickBooks Online: Foreign transaction tracking, exchange rate updates, and integration with accounting tools.

Quick Comparison

| Tool | Currency Support | Key Features | Starting Price |

|---|---|---|---|

| Maybe Finance | 10,000+ institutions | Real-time tracking, auto conversion | $9/month |

| Revolut | 150+ currencies | Real-time analytics, fraud prevention | Free (limits apply) |

| Wise | 40+ currencies | Mid-market rates, fast transfers | From 0.33% fees |

| YNAB | Manual setup | Zero-based budgeting, travel tracking | $14.99/month |

| Personal Capital | Unified dashboard | Account integration, spending insights | Free |

| Monzo | Mastercard rates | Fee-free withdrawals, live exchange rates | Free (limits apply) |

| Expensify | 159+ currencies | Auto conversions, platform integrations | $5/user/month |

| Mint | 17,000 institutions | Real-time tracking, spending analysis | Free |

| Xero | 160+ currencies | Multi-currency invoicing, reporting | $13/month |

| QuickBooks Online | Foreign transactions | Exchange rate updates, integrations | $30/month |

Choose a tool based on your needs - whether it’s real-time tracking, detailed reporting, or seamless integrations. These solutions make managing global expenses simpler and more effective.

1. Maybe Finance

Maybe Finance is a multi-currency expense tracker that helps you manage your finances across borders. With connections to over 10,000 financial institutions, it simplifies handling international transactions [2]. Here’s a closer look at its standout features.

Key Multi-Currency Features:

- Real-Time Exchange Tracking: Automatically monitors currency fluctuations to keep your financial data accurate.

- Global Account Integration: Link personal and business accounts from institutions in both the US and EU, with future plans to expand [2].

- Automated Currency Conversion: Transactions are converted into your chosen base currency, giving you a clear financial overview.

Subscriptions are available for $9/month or $90/year (save 17%) and include unlimited account connections and full currency support.

Account Management Features:

| Feature | Details |

|---|---|

| Institution Coverage | Connect with 10,000+ banks and institutions |

| Geographic Support | US and EU, with plans to grow further |

| Currency Handling | Automatic conversion and live tracking |

| Account Types | Supports both personal and business accounts |

Maybe Finance simplifies managing international finances with automated tools and precise tracking.

2. Revolut

Revolut is a powerful tool for managing expenses in multiple currencies. It supports spending in over 150 currencies and lets users hold up to 36 currencies directly within the app [5]. Its currency management features make it a go-to option for tracking international expenses.

Multi-Currency Capabilities

| Feature | Details |

|---|---|

| Currency Support | Hold 36 currencies, spend in 150+ currencies |

| Exchange Coverage | 25+ currencies with no fees (within limits) |

| Transfer Network | Send money to 160+ countries |

| Weekend Exchange | 1% fee (Standard plan), 0.5% fee (Plus plan) |

| Exchange Limits | $1,000 per month fee-free (Standard plan) |

These features form the foundation for its advanced expense management tools.

Advanced Expense Tracking Tools

Revolut provides tools to simplify managing international expenses. Users can automatically allocate funds for bills, savings, and spending. The "Pockets" feature enables the creation of dedicated sub-accounts for specific purposes, such as subscriptions or travel.

Real-Time Monitoring and Insights

Revolut goes beyond basic tracking by offering real-time analytics, including:

- Instant exchange rate updates with notifications

- Customizable spending categories

- Alerts for budget limits

- Integration with external accounts

"Revolut Business has helped our finance team become more agile, and keep track of the team's expenses in real-time."

– Adriana Sarbu, CFO, Karpaten [6]

The platform has also been effective in fraud prevention, stopping over £632 million in fraudulent transactions in 2023 [3]. With more than 50 million users worldwide [4] and a 4.9/5 rating from 868,000 reviews [5], Revolut continues to stand out.

Managing Exchange Rates

For users dealing with fluctuating currencies, Revolut offers:

- Interbank exchange rates on weekdays

- Stop and limit orders for automated currency exchanges

- Real-time rate tracking and alerts

Exchange rates are updated continuously [5], helping users decide the best time to convert currencies.

3. Wise

Wise simplifies international finance by combining automated currency conversion with business tools. Handling $13 billion monthly from 10 million customers, Wise makes managing multiple currencies easier for individuals and businesses alike [7]. Let’s dive into how Wise’s features can help streamline global expense management.

Multi-Currency Management Features

| Feature | Description |

|---|---|

| Supported Currencies | Hold and convert over 40 currencies |

| Account Types | Access local account details in 8 major currencies |

| Rate Transparency | Uses mid-market rates with clear fees |

| Transfer Speed | Over 50% of transfers complete in under 20 seconds |

| Business Integration | Works with major accounting platforms |

Advanced Tracking Capabilities

Wise offers tools to track spending across currencies, catering to both personal and business needs. It automatically exchanges currencies at user-preferred rates, simplifying financial management [8].

Business Integration and Automation

Wise integrates smoothly with accounting platforms, enhancing efficiency for businesses:

- Automated Synchronization: Transactions sync every 4 hours with supported accounting software [10].

- API Functionality:

- Automate recurring payments and payroll

- Generate payments directly from invoicing software

- Receive real-time alerts

- Automatically track exchange rates [11]

Cost Structure

Wise’s pricing is straightforward and competitive:

- Money transfers start at 0.33%

- Receiving payments is free after a one-time setup fee

- Wire transfers cost a flat $6.11 [9]

"Always fast transactions and good fees. An invaluable online bank for those who live outside their own country or are frequent travelers." – Megan, Trustpilot [7]

With a 4.3/5 rating on Trustpilot and 4.8/5 on both the App Store and Google Play, Wise is trusted by over 600,000 businesses worldwide [7].

4. YNAB

YNAB offers a structured approach to budgeting that directly tackles issues like exchange rate changes and conversion fees, making it a practical tool for managing multiple currencies. Its system emphasizes clarity and precision in handling international transactions.

Multi-Currency Management Strategy

| Feature | How It Works |

|---|---|

| Currency Separation | Create individual budgets using YNAB's zero-based method |

| Transfer Tracking | Assign a 'Currency Transfer' category for easy monitoring |

| Travel Expenses | Use a single category for all foreign spending |

| Transaction Recording | Record transactions in their original currency in the memo field |

Currency-Specific Budgeting

Set up separate budgets for each currency you frequently use. This method simplifies tracking exchange rate changes, conversion fees, and international transaction costs. It also works seamlessly with YNAB's tools, making it easier to monitor and manage travel-related expenses.

Practical Example

Imagine a digital nomad working with CAD, PHP, and EUR. They create distinct budgets for each currency. For example, they record a €1,000 outflow in the EUR budget, a CAD 1,500 income in the CAD budget, and log any fees separately for better transparency [1].

Managing Travel Expenses

For short-term travel, YNAB provides a simple yet effective way to track foreign spending:

- Add a 'Vacation' category to your budget.

- Flag all foreign transactions for easy identification.

- Use the memo field to note the original amounts.

- Update the amounts once bank charges are finalized.

Advanced Tools

YNAB's API opens the door for third-party integrations, offering even more control over currency management. For instance, the "Multi-Currency for YNAB" service can automate currency conversions, saving time and effort [1].

Key considerations to keep track of:

- Exchange rate changes

- Processing times for transactions

- International banking fees

- Currency conversion costs

5. Personal Capital

Personal Capital brings all your financial accounts together in one place, offering a streamlined dashboard that covers checking, savings, credit, investments, retirement, loans, and mortgages [12].

Account Integration

This tool connects to a variety of financial accounts, giving you a complete view of your financial life - from everyday expenses to long-term investments - all within a single platform.

Automated Financial Tracking

The platform updates and organizes your financial data automatically, saving you time and effort. Here's how you can get started:

Connect Your Accounts

Link your banking, credit, and investment accounts to keep your financial data updated and organized.Manage Your Finances

Combine all your accounts into one view to monitor spending and track patterns effortlessly.

Key Features

Personal Capital offers a range of tools to help you stay on top of your finances:

- Net Worth Tracking: Automatically calculates your net worth by combining balances from all linked accounts.

- Spending Insights: Provides a detailed breakdown of your spending habits.

- Investment Monitoring: Keeps tabs on the performance of your investment accounts.

- Real-Time Updates: Ensures your financial data stays current across all connected accounts.

Why Use Personal Capital?

By connecting with numerous financial institutions, Personal Capital eliminates the need to juggle multiple apps. This all-in-one solution simplifies account management and helps you maintain better control over your financial health.

6. Monzo

Monzo makes managing multiple currencies straightforward with its user-friendly mobile app. It covers everything from currency exchange and transaction tracking to flexible withdrawal options, catering to both personal and business needs.

Currency Exchange Features

Monzo relies on Mastercard's exchange rate system, which updates daily [14]. This ensures users get competitive rates without hidden fees [13]. The app also displays live exchange rates, helping users make smart spending choices while traveling.

Managing International Transactions

Monzo provides several tools to handle international spending efficiently:

- Real-time notifications for transactions, helping users keep track of their spending

- Trip reports summarizing expenses during international travel

- Instant card freeze through the app in case of loss or theft [13]

Cash Withdrawal Options

Monzo offers different fee-free cash withdrawal limits depending on the account type:

| Account Type | UK & EEA Area | Outside EEA |

|---|---|---|

| Standard (Not Main Bank) | $400 fee-free every 30 days | $200 fee-free every 30 days |

| Standard (Main Bank) | Unlimited fee-free | $200 fee-free every 30 days |

| Monzo Plus | Unlimited fee-free | $400 fee-free every 30 days |

| Monzo Max | Unlimited fee-free | $600 fee-free every 30 days |

Withdrawals exceeding these limits incur a 3% fee [13][16]. Business accounts also benefit from similar international capabilities.

Features for Business Accounts

Monzo supports businesses with advanced international tools:

- Send money to over 70 countries

- Accept payments in more than 40 currencies

- A 1% conversion fee on incoming international payments, capped at $1,000 per transaction [15][17]

"Pay anywhere and in any currency – on your debit or credit card – with no foreign transaction fees or hidden costs. That leaves more money for souvenir T-shirts. We pass Mastercard's exchange rate directly onto you, without any sneaky fees." – Monzo [13]

Premium Features

The Monzo Max subscription, priced at $17 per month, includes:

- Worldwide travel insurance

- Higher fee-free withdrawal limits for international use [13]

With its real-time updates, transparent exchange rates, and flexible account options, Monzo makes managing multi-currency expenses hassle-free.

7. Expensify

Expensify simplifies international expense tracking by supporting over 159 currencies and automating currency conversions.

Currency Management System

Expensify uses Open Exchange Rates to handle currency conversions automatically. Expenses are converted using the daily average exchange rates from the transaction date [18].

Global Reimbursement Capabilities

Expensify supports a wide range of global reimbursement features:

| Feature | Coverage |

|---|---|

| Withdrawal Support | 24 countries |

| Deposit Coverage | 190+ countries |

| Supported Currencies | USD, CAD, GBP, EUR, AUD |

| Available Currencies | 159+ currencies |

These features help businesses manage expenses smoothly across multiple regions.

Workspace Organization

Expensify offers an efficient way to organize workspaces, leveraging its currency management system. Each workspace can have a default currency setting, overriding individual user preferences [18]. Here's how you can set it up:

| Workspace Type | Suggested Currency Setup |

|---|---|

| Regional Office | Use the local currency as default |

| Global HQ | Set the primary reporting currency |

| Project-Based | Align the currency with project needs |

This flexibility ensures that financial processes align with specific business requirements.

International Payment Features

Expensify includes integrated payment tools to simplify global transactions. For instance, the Expensify Card eliminates foreign transaction fees and automatically imports expenses into reports [19][20].

Integration Capabilities

Expensify connects with over 45 financial platforms [21], making it easy to integrate with your existing tools. Supported platforms include:

- Accounting Software: QuickBooks, Xero, Sage Intacct

- ERP Systems: NetSuite, Workday

- Payment Platforms: PayPal

- Automation Tools: Zapier

These integrations enable a smooth transfer of financial data across systems.

Advanced Features

Expensify provides additional tools to streamline international expense management:

- Real-Time Currency Updates: Daily exchange rates ensure accurate conversions.

- Historical Rate Tracking: Records expenses in their original currency [18].

- Policy Management: Create region-specific rules to meet local needs [19].

- Automated Conversions: Instantly calculates expenses in the default currency.

These features make Expensify a reliable choice for managing global expenses effectively.

8. Mint

Mint connects with over 17,000 financial institutions, providing a clear overview of your spending across multiple currencies [22][24].

Account Integration System

With Mint, you can link thousands of financial accounts in one place. This makes it easier to track and manage your transactions without juggling multiple platforms [22][24].

Transaction Management and Monitoring

Mint simplifies financial tracking with these features:

| Feature | What It Does |

|---|---|

| Transaction Monitoring | Keeps tabs on all transactions from linked accounts |

| Category Management | Organizes expenses into categories |

| Spending Analysis | Highlights patterns and unnecessary costs |

| Monthly Insights | Offers detailed breakdowns of spending |

| Trend Analysis | Shows changes in spending over time |

| Cross-Account Search | Lets you find specific transactions easily |

These tools provide a better understanding of your financial habits.

Advanced Features

Mint goes beyond basic tracking with:

- Comprehensive Search: Quickly find transactions across all accounts [23].

- Custom Categories: Tailor expense categories to fit your unique needs.

- Automated Updates: Syncs with your accounts in real time for up-to-date information.

Integration Process

To make the most of Mint, follow these steps:

- Link all your financial accounts.

- Regularly review and categorize your transactions.

- Use monthly insights to spot spending trends.

- Take advantage of the search tool to locate specific expenses.

- Analyze your spending across different categories for better budgeting.

9. Xero

Xero simplifies managing international expenses with its multi-currency accounting tools, including real-time exchange rate updates. It supports invoicing and receiving payments in over 160 currencies, making it a valuable resource for businesses with global operations [25].

Real-Time Currency Management

Xero keeps exchange rates up to date during transactions, ensuring accurate financial data. If needed, users can also adjust exchange rates to suit specific business requirements.

Multi-Currency Features

| Feature | Description |

|---|---|

| Automated Conversions | Updates currencies in real time during transactions |

| Contact Currency Settings | Assigns default currencies to individual contacts |

| Financial Reporting | Creates consolidated statements across currencies |

| Exchange Rate Monitoring | Tracks rate changes and their impact on cash flow |

| Global Invoicing | Enables quotes and invoices in over 160 currencies |

These features provide businesses with better control and clarity over their finances.

Financial Visibility

Xero builds on its currency tools to offer a clear view of international accounts. According to a survey, 87% of users reported improved financial visibility [25]. With Xero, businesses can:

- Track how exchange rates impact profits

- Monitor cash flow across borders

- Keep precise financial records

- Generate detailed, currency-specific reports

International Transaction Management

Xero streamlines global financial tasks by adhering to international standards and reducing paperwork.

"Xero became a really critical tool for us as we took on more staff." - Kate, Xero User [25]

Advanced Currency Controls

Xero's currency management tools allow users to:

- Assign default currencies to specific contacts

- Monitor exchange rate changes in real time

- Create consolidated financial statements

- Track profits across multiple currencies

- Handle international invoicing with ease

10. QuickBooks Online

QuickBooks Online helps businesses manage transactions in different currencies through its Essentials, Plus, and Advanced plans [26].

Multicurrency Management Features

| Feature | Description |

|---|---|

| Foreign Currency Recording | Track transactions in various foreign currencies |

| Exchange Rate Updates | Updates exchange rates every 4 hours via Wall Street On Demand |

| Currency Assignment | Assign specific currencies to customers and vendors |

| Bank Integration | Handle deposits in multiple currencies |

| Manual Controls | Input custom exchange rates when needed |

Core Functionality

QuickBooks Online automatically converts foreign transactions into your home currency using updated exchange rates every four hours. To keep things organized, you can create separate accounts for each foreign currency and assign them to specific customer or vendor profiles [26][27].

International Payment Processing

If your business deals with global transactions, QuickBooks Online offers:

- Foreign currency invoicing

- Multi-currency expense tracking

- Cross-border payment handling

- Automated bank feed integration

Advanced Currency Controls

QuickBooks Online provides tools to simplify international financial management:

- Set default currencies for individual contacts.

- Track exchange rate changes with automatic updates every four hours.

- Create financial reports tailored to specific currencies.

- Monitor international cash flow with ease.

These features make managing cross-border transactions more efficient and integrate smoothly with your existing financial systems.

Integration Capabilities

QuickBooks Online works with various financial platforms like bank accounts, credit cards, PayPal, and Square, making it easier to track expenses across different currencies [28].

Best Practices

To get the most out of QuickBooks Online’s multicurrency features:

- Consult with an accountant before enabling multicurrency [26].

- Set up separate accounts for each currency to simplify reconciliation [29].

- Link business credit cards for automatic transaction imports [30].

Feature Comparison

This section breaks down and compares key functionalities that simplify multi-currency tracking. Features like real-time exchange rate updates, expense categorization, and user-friendly designs play a big role in making these tools effective.

Real-Time Exchange Rate Updates

| Tool | Update Frequency | Rate Source |

|---|---|---|

| Maybe Finance | Real-time | Global providers |

| ClearBooks | Daily | XE rates |

| Tipalti | Real-time | Market rates |

| MYOB | Automated | Market rates |

| Prismatic | Real-time | Market rates |

Real-time exchange rates ensure your financial data stays accurate and up-to-date. This precision is crucial when managing expenses across multiple currencies.

Expense Categorization Capabilities

Automated categorization and the ability to create custom categories make organizing expenses easier and more consistent, regardless of the currencies involved.

User Experience Considerations

The best tools prioritize usability. Key features include:

- Easy-to-navigate interfaces

- Customizable dashboards with clear transaction histories

- Automated currency conversion

- Mobile compatibility for on-the-go access

These features not only simplify daily operations but also work seamlessly with advanced currency management tools to give you better financial control.

Advanced Currency Management

| Feature | Description | Business Impact |

|---|---|---|

| Realized Gain/Loss Tracking | Automatically calculates fluctuations | Improves financial accuracy |

| Multi-Base Currencies | Supports multiple home currencies | Enhances regional management |

| Consolidated Reporting | Combines reports across currencies | Simplifies global oversight |

| FX Risk Management | Monitors exchange rate exposure | Reduces currency risk |

Choosing the right tool depends on your specific needs, such as the volume of transactions, the number of currencies you manage, and your reporting requirements. Aligning the tool's features with these factors ensures you get the most out of your currency management system.

Summary

Managing multiple currencies effectively starts with understanding the key features you need. Focus on tools that provide real-time exchange rate updates and automated conversions to simplify global expense tracking.

When choosing a multi-currency tool, consider these essential features:

- Integration Capabilities: Ensure the tool works smoothly with your ERP, CRM, and accounting systems.

- Security and Compliance: Look for strong encryption and adherence to financial regulations to safeguard sensitive data.

- Customization and Scalability: Choose a solution that can grow with your business and adapt to changing requirements.

Here's a quick guide to help you prioritize based on your business size:

| Business Size | Key Priority Features | Recommended Focus |

|---|---|---|

| Small Business | Cost-effectiveness, ease of use | Basic currency conversion, simple reporting |

| Mid-sized | Automation, integration | Multi-currency support, consolidated reporting |

| Enterprise | Advanced compliance, customization | FX risk management, global oversight |

These considerations, combined with the tool features discussed earlier, can help you create a more efficient global expense management system.

FAQs

What should I consider when choosing a tool to track spending across multiple currencies?

When selecting a tool to track spending across multiple currencies, start by identifying your specific needs. Consider factors like the number of currencies you work with, whether you need automatic currency conversion, or if integration with other financial systems is important. Tools that offer real-time exchange rates and support for a wide range of currencies can simplify tracking and provide accurate insights.

If you're managing international transactions for a business, look for software that supports multi-currency invoicing and expense tracking while integrating seamlessly with your existing systems. For personal use, prioritize ease of use and features like automatic updates for exchange rates. By focusing on these key aspects, you can find a solution tailored to your financial goals.

What features should I look for in a tool to track expenses across multiple currencies effectively?

When choosing a tool for tracking expenses in multiple currencies, look for features that ensure both accuracy and convenience. Key features include:

- Real-time currency conversion: The tool should automatically update exchange rates to reflect the most current values.

- Support for multiple currencies per transaction: It should allow you to record and manage transactions in different currencies seamlessly.

- Clear and customizable financial reports: The tool should generate easy-to-read reports that display expenses in both the original and converted currencies.

These features help you stay on top of your finances, avoid manual errors, and maintain transparency when managing cross-border transactions.

How do exchange rate changes affect international transactions, and how can I manage them effectively?

Exchange rate fluctuations can impact international transactions by changing the value of your income and expenses when converted to your base currency. This can influence profitability and overall financial planning. For example, a stronger dollar might reduce the cost of imports but lower the value of overseas earnings.

To manage these changes, consider using tools or strategies like hedging (e.g., forward contracts or options) to lock in exchange rates and reduce uncertainty. Diversifying operations across multiple currencies can also help balance risks. Regularly monitoring exchange rates and adjusting your financial strategies ensures you stay proactive and minimize potential impacts.

Subscribe to get the latest updates right in your inbox!