Cryptocurrency as a part of your investment portfolio

A cryptocurrency (aka crypto) is a form of currency that exists only digitally or virtually and uses the process of cryptography to secure transactions made with the currency. It is a combination of crypto, which comes from the Greek word ‘Kryptos,’ meaning ‘secret or hidden’, and currency, which has referred to forms of money since the 1700s.

The technology behind cryptocurrencies

Initially, cryptocurrencies were dismissed as a fad among the majority of investors. Now, after the rise of cryptocurrencies like Bitcoin over more than 12 years, the concept is here to stay. Even if you’re not planning on investing in crypto right away, learning about the underlying technologies that propel this emerging asset class will be beneficial.

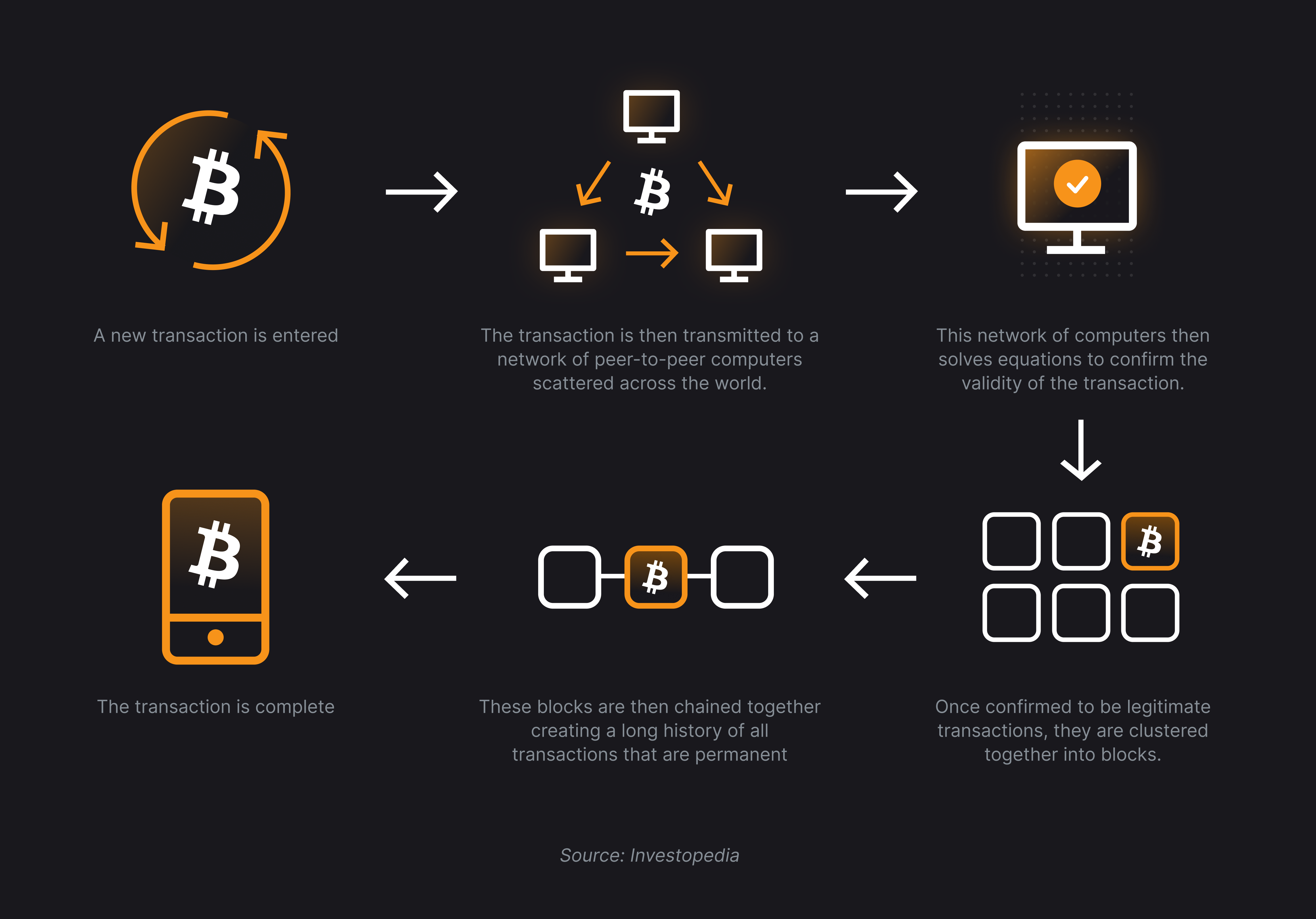

The underlying technology that powers the majority of cryptocurrencies is the blockchain. Even though the origins of this technology are unknown to a vast extent, it was popularized through the publishing of the Bitcoin whitepaper in which an individual calling themselves Satoshi Nakamoto wrote about how two individuals can send payments to each other anonymously without the need for trust between parties and without the involvement of a financial institution.

The role of blockchain in cryptocurrencies is to serve as a database for maintaining a secure and decentralized record of transactions. The utility that blockchain provides is that it ensures the security and accuracy of the data recording. The parties using the blockchain to carry out transactions do not need to trust each other, only the fidelity and security of the blockchain network.

Cryptocurrencies like Bitcoin use blockchains to store transaction information between parties in blocks. As more and more transactions are processed, more blocks are formed and linked to each other, creating a chain of blocks in which each block connects to the preceding one. This interlinking of blocks with one another is why the technology is known as the " blockchain." To better understand how bitcoin and the blockchain work, you can look at this fantastic video by the YouTube channel 3Blue1Brown on "How Bitcoin works?”

Historical performance of cryptocurrencies

Now that we know the basics about how cryptocurrencies work using the underlying blockchain technology let us see how the two major cryptocurrencies - Bitcoin and Ethereum , have performed over time.

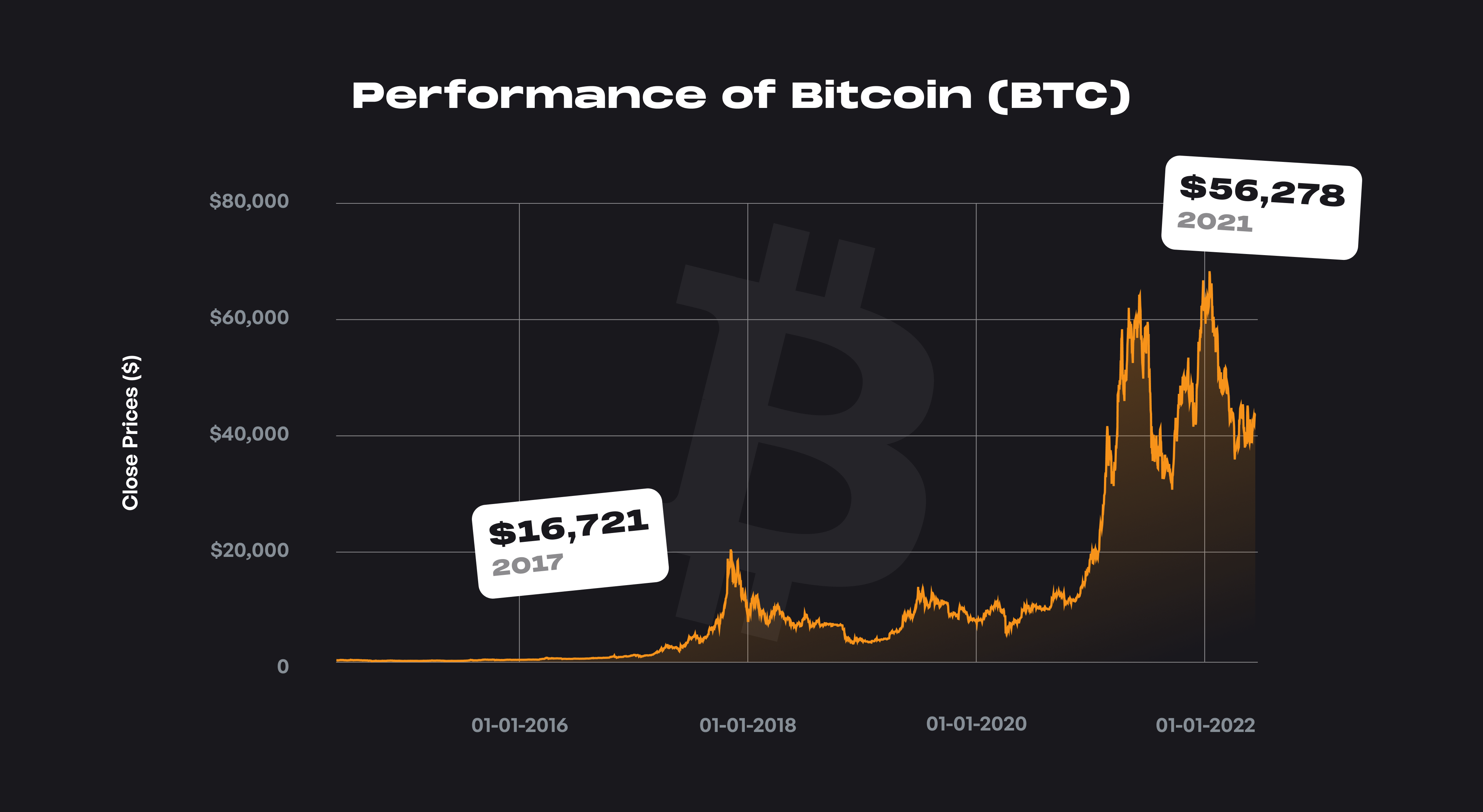

Performance of Bitcoin - CAGR and volatility

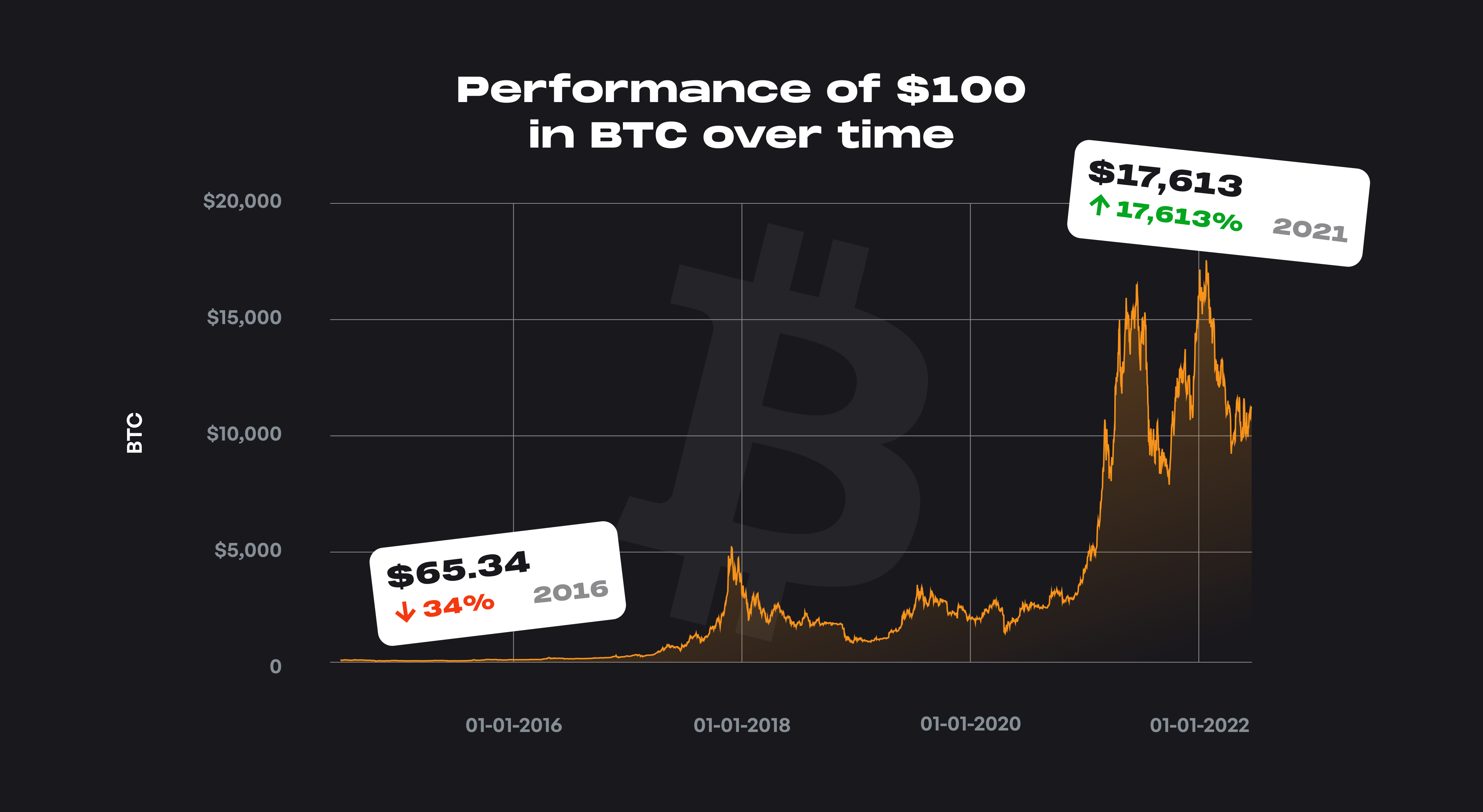

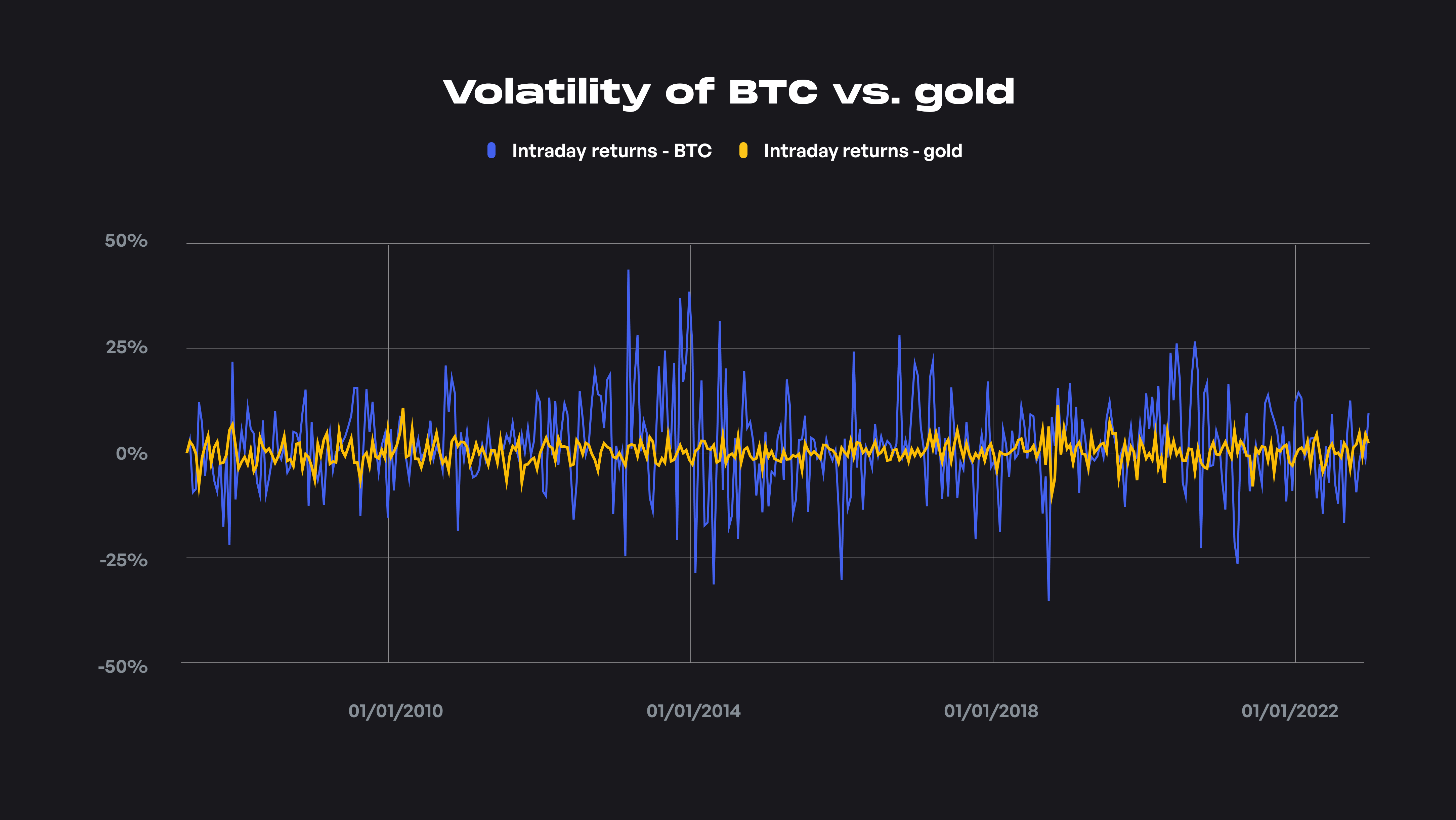

Since October 2014, Bitcoin has given a Compound Annual Growth Rate (CAGR) of 63% annually with a volatility of 74.20%.

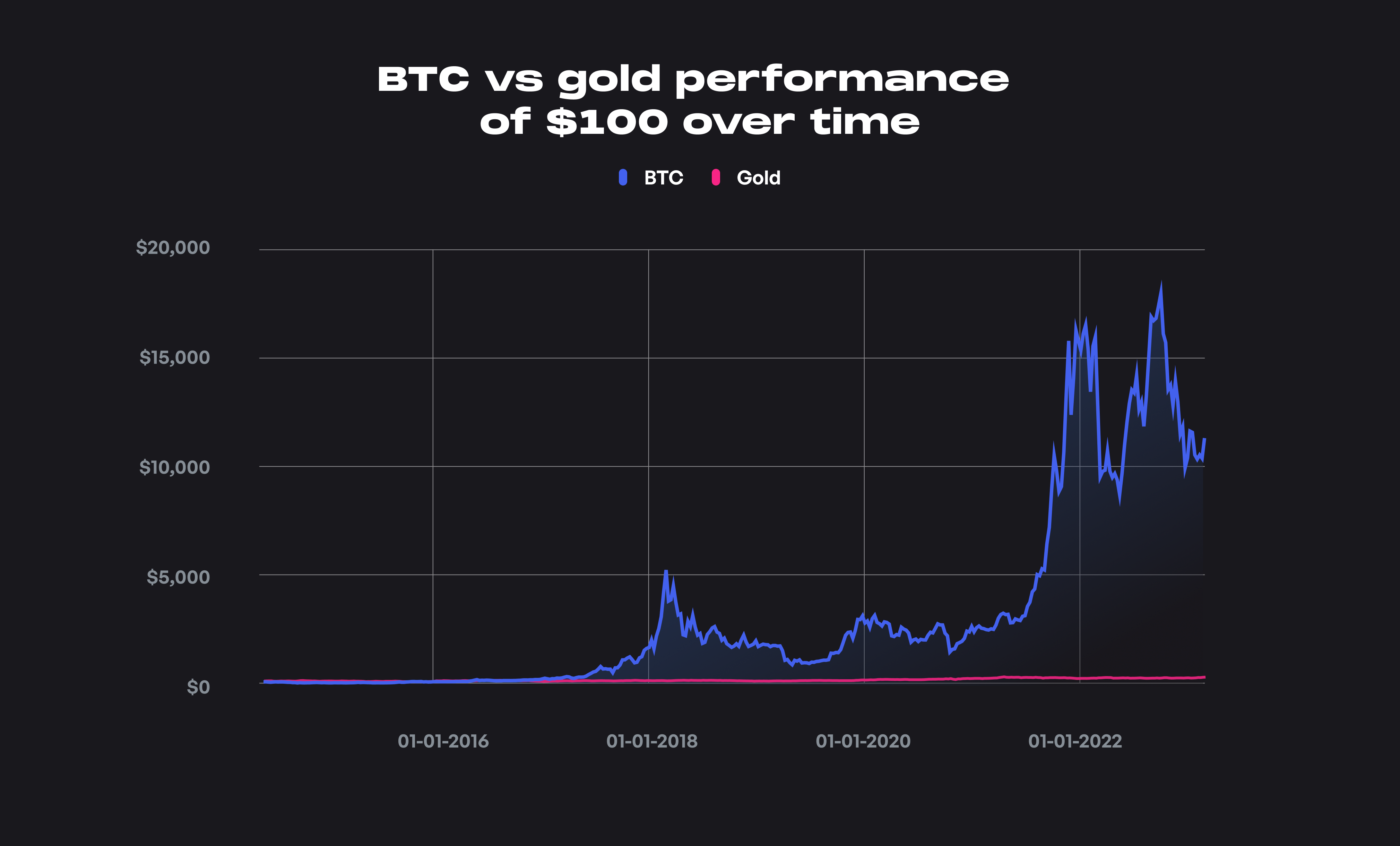

In dollar terms, $100 invested in Bitcoin on October 1st, 2014, would have turned into $11,172 by March 24th, 2022.

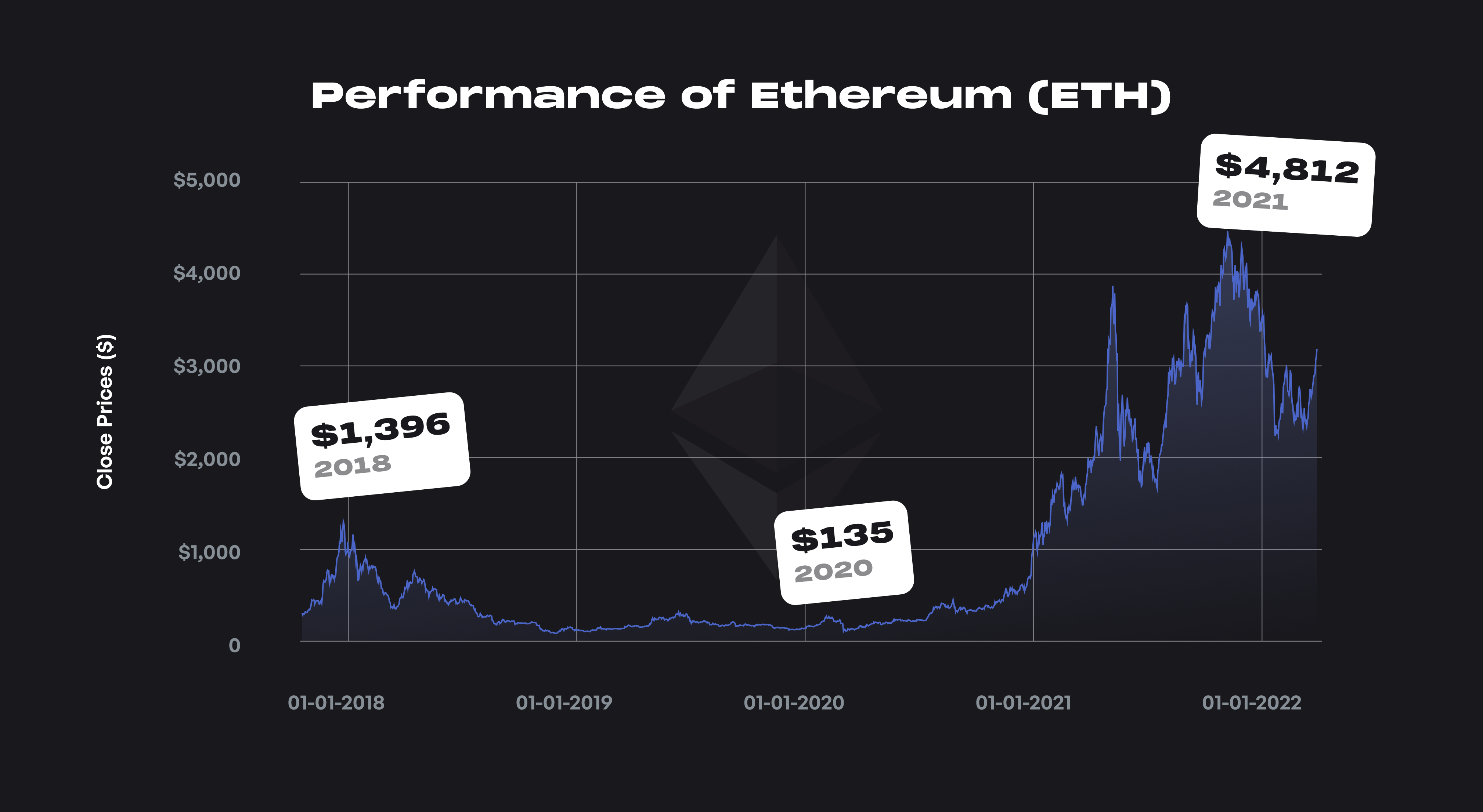

Performance of Ethereum - CAGR and volatility

Since November 2017, Ethereum has given a Compound Annual Growth Rate (CAGR) of 54%, with an annualized volatility of 98%.

In dollar terms, a $100 invested in Ethereum on November 9th, 2017, would have turned into $1,067.80 on March 29th, 2022.

Bitcoin - is it “digital gold?”

A lot of young investors are referring to the cryptocurrency Bitcoin as "Digital gold” as it possesses specific characteristics of gold, such as a fixed supply (there will never be more than 21 million Bitcoin) and the fact that anything becomes a store of value when everyone agrees that it has value.

Also, the reward for mining a bitcoin halves after every 210,000 blocks are mined, which means that the rate at which new bitcoins are created over time will decrease till around the year 2140 when all of the 21 million bitcoins would have been mined. This halving lowers the available new supply, even if the demand is constant, thus driving up the price. Bitcoin halving generally occurs once every four years.

Imagining this in the context of gold, if the quantity of new gold mined is halved every four years, then as long as demand is constant, the price of gold will increase due to limited new supply.

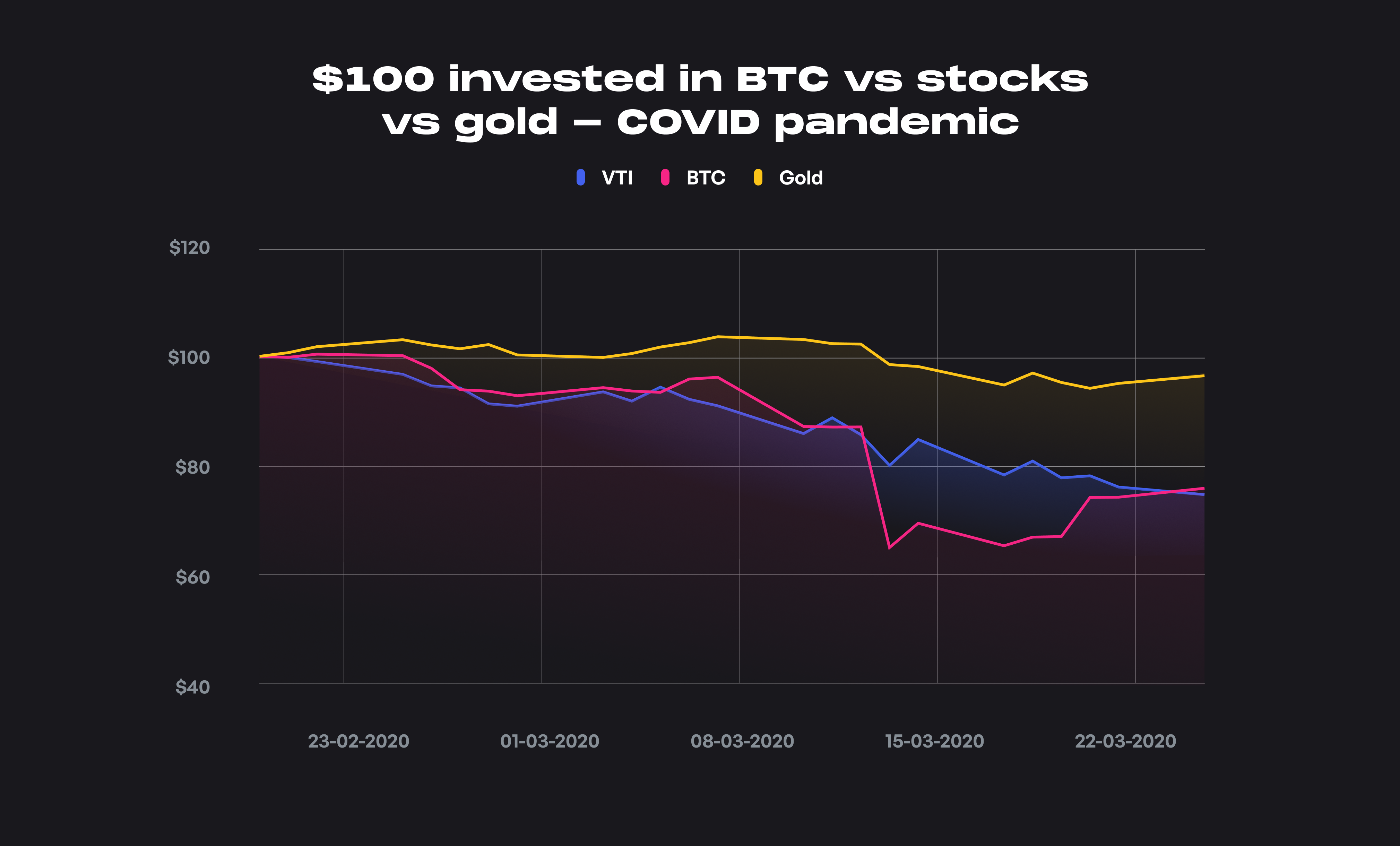

However, let us take a data-driven approach to see how Bitcoin has performed during periods of crises where gold is seen as a haven for investments. Bitcoin was not around during the Dot-com bust or the 2008 financial crisis, so the only crisis event where stock market valuations plunged since Bitcoin began was during the COVID crash in March 2020.

To look at how different assets performed during the COVID crisis, let us see the performance of $100 invested in stocks (VTI - Total US Stock market index fund ETF), Bitcoin, and gold. We can see that although all three instruments saw a decline in value, gold has vastly outperformed the performance of stocks and bitcoin.

In this crisis, bitcoin acted like it was a risky stock and lost as much value as that of the US stock market index fund (see the table below for a comparison of returns). However, gold was able to weather the crash in asset prices to some degree. The crash in stock and bitcoin prices was seven times that of the reduction in the price of gold.

Bitcoin also had a very high positive correlation (63%) with stock prices (Bitcoin generally moved up and down in tandem with stock prices), which means that at least during the COVID crisis, bitcoin wasn't a haven for investors, unlike gold.

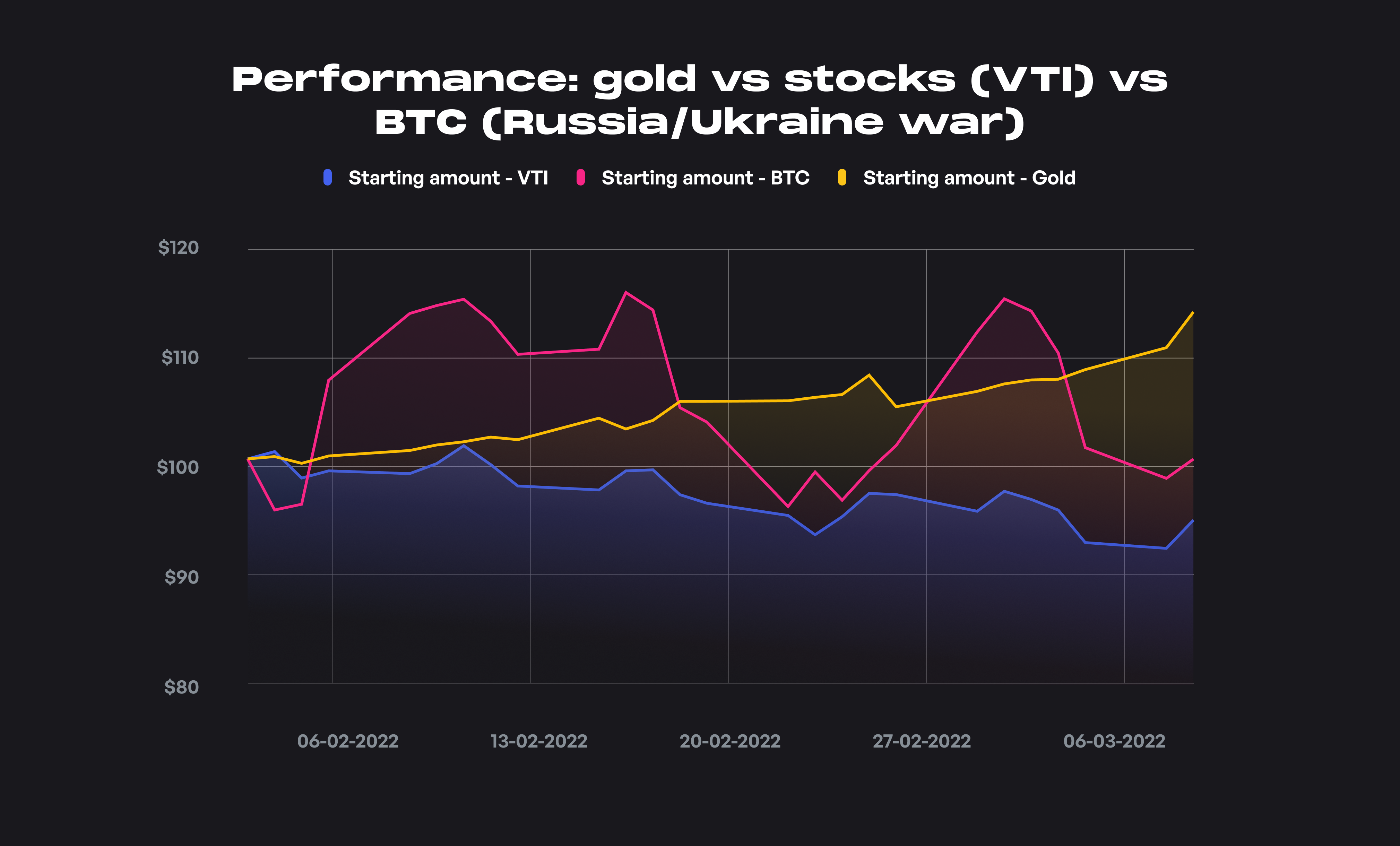

Let us also take a quick look at the performance of the same three instruments during times of war (such as the 2022 Russia/Ukraine war). Below is the performance of $100 each invested into Bitcoin, stocks, and gold during the initial stages of the war.

Bitcoin performed decently well during this crisis, almost remaining flat but with immense volatility. Stocks lost a little more than 5% of their value, whereas gold increased by 13%. During this event, there was a slight positive correlation (35%) between Bitcoin and stocks (VTI) and no correlation (-1.81%) between Bitcoin and Gold.

(View all data and analysis here.)

Bitcoin vs. Gold - Performance and volatility

Let us move on to how Bitcoin has performed versus gold over the past eight years. Taking data from October 3rd, 2014, for both Bitcoin and gold, we can see that $100 invested in Bitcoin on the date mentioned above would have turned into $10,896.30 by March 2022. The same $100 invested in gold in 2014 would have turned into $165.58 by March 2022.

Next, looking at volatility, we can see that bitcoin has a much higher volatility than gold. (For exact figures of CAGR and volatility, view the table below - data taken from 2014-2022)

| Instrument | CAGR | Volatility |

|---|---|---|

| Bitcoin (BTC) | 63.09% | 75.39% |

| Gold | 6.75% | 14.03% |

Looking at the table above, we can see that investors are compensated for holding onto a highly volatile asset like Bitcoin with high annualized returns. Gold, however, is much less volatile and produces average returns. The correlation in price movements between gold and Bitcoin is also a very weak negative correlation (-8.70%) which means that t he two asset classes generally do not move in tandem.

Holding crypto in your portfolio

Cryptocurrencies have been around for just a little more than a decade and are still in their infancy as an asset class. Crypto should still be considered a highly volatile and speculative instrument, and generally, many financial experts advise that your crypto holdings shouldn't exceed 5-10% of your overall portfolio value.

Also, initially, it is wise to focus on the more established cryptocurrencies, such as Bitcoin and Ethereum, which have been around for quite some time and have some institutional backing. Then once you're a bit accustomed to the crypto space, you can create a satellite portfolio (in addition to your core portfolio of Bitcoin and Ethereum) with other cryptocurrencies or coins relevant to themes like Defi, the metaverse, NFTs, and so on for extra diversification.

The core portfolio should consist of 70-100% of your crypto holdings. You can have a satellite portfolio of 0-30% of your crypto holdings, which you can use to hold higher risk-reward cryptocurrencies and related assets.

Holding cryptocurrencies for longer time horizons (10 years and above), dollar cost averaging your crypto purchases, and rebalancing your crypto portfolio to maintain your desired target allocation can help reduce the volatility of your portfolio and improve returns. Also, holding only established cryptocurrencies as a significant component of your crypto portfolio can help dampen volatility and offer more emotional stability than new and upcoming cryptocurrencies.

Diversification is the key to mitigating risk, especially in volatile asset classes like crypto. Do check out our free Crypto Index Fund mini tool which you can use to simulate investments and view returns of various crypto themes (DeFi, NFTs, Blue Chip) using a selection of premade crypto index funds.

Key takeaways

- Cryptocurrencies run on blockchain technology which facilitates transactions between two parties without an intermediary (like a bank) to facilitate and verify the transaction. Crypto also doesn't require trust between the sender and receiver to complete a transaction.

- Cryptocurrencies (like Bitcoin and Ethereum) have given much higher returns on an annualized basis when compared to asset classes such as stocks and gold. However, these excess returns have come with huge fluctuations (volatility) in the value of these cryptocurrencies.

- Bitcoin hasn't shown its mettle as an alternative to gold during major crises like the COVID crash. During the crash, bitcoin behaved like a risky stock, falling in value by the same amount as that of the US stock market while the price of gold remained relatively steady.

- Crypto is still a highly speculative and volatile asset class in its infancy in terms of the underlying technology and its applications, and its utility as an asset class in your investment portfolio.

- Due to the highly speculative nature of cryptocurrencies, many experts recommend that most investors hold not more than 5-10% of their portfolios in crypto. The investing best practices such as having a long time horizon, dollar-cost averaging, rebalancing, and diversification apply to crypto as well.

Subscribe to get the latest updates right in your inbox!