How to Automate Savings for Long-Term Goals

Automating your savings is a simple way to consistently work toward your financial goals without extra effort. Here's how you can get started:

- Set Clear Goals: Define what you're saving for, how much you need, and your timeline. For example, saving $60,000 for a house in 3 years means setting aside $1,667/month.

- Review Your Finances: Analyze your income, expenses, and current savings to understand what you can allocate toward your goals.

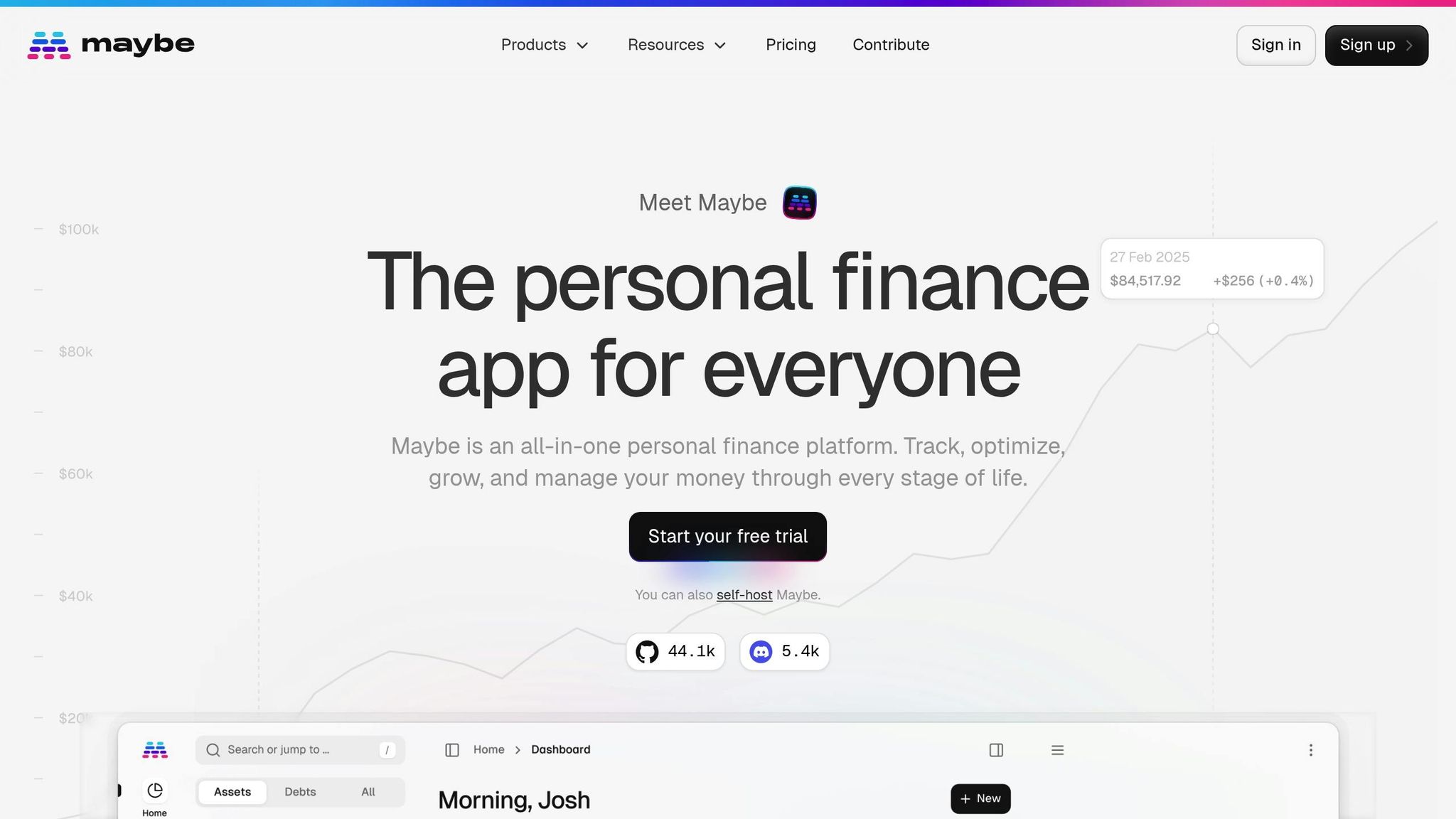

- Schedule Transfers: Automate recurring transfers to savings accounts right after payday. Platforms like Maybe Finance can make this seamless.

- Use Smart Tools: Features like goal tracking, AI insights, and customizable rules help you save efficiently and adjust as needed.

Start small and gradually increase your savings. With tools like Maybe Finance, you can track progress, manage extra income, and refine your strategy over time. Let technology handle the details while you stay focused on your goals.

Setting Up Your Automated Savings

Review Your Current Finances

Start by taking a close look at your finances and monthly cash flow. Maybe Finance's tracking tools make this easy by letting you link your financial accounts to automatically import and categorize your transactions.

Pay attention to:

- Your average monthly income after taxes

- Fixed expenses like rent, utilities, and insurance

- Variable spending habits in areas such as dining, entertainment, and shopping

- Current savings and investments, so you know where you stand

Once you've got a clear picture of your financial situation, you're ready to set specific savings goals.

Set Specific Savings Goals

Having clear, measurable goals makes saving easier and more effective. For each goal, define:

- The total amount you need

- Your deadline for reaching it

- How much you need to save each month

For instance, if you're saving for a $60,000 down payment on a house and want to hit that goal in three years, you'd need to save about $1,667 a month if you're starting from scratch. Maybe Finance helps you track this progress and tweak your plan as needed.

After setting your goals, the next step is to automate your savings.

Schedule Regular Transfers

Automating your savings is the key to staying consistent. Use Maybe Finance to set up recurring transfers that align with your pay schedule.

Here are a few tips to make it work smoothly:

- Schedule transfers 1–2 days after your paycheck hits your account

- Start with an amount that feels manageable and sustainable

- Create separate transfers for each savings goal to stay organized

- Use Maybe Finance's transaction rules to automatically track and categorize your savings

Key Features for Savings Automation

Must-Have Savings Tool Functions

To make savings automation truly effective, certain features are essential. These tools simplify the process and help you stay aligned with your financial goals.

Automatic Transfer Scheduling allows you to set recurring transfers that match your pay schedule. This feature ensures consistency while offering the flexibility to adjust as needed.

Goal-Based Tracking helps turn your savings targets into achievable milestones. With tools like interactive charts and real-time updates, you can clearly see how close you are to reaching your financial objectives.

Smart Rules Engine enables custom automation based on your income and spending habits. For instance, you can save a percentage of irregular income or round up purchases to boost your savings effortlessly.

| Feature | Purpose | Impact |

|---|---|---|

| Automatic Transfers | Regular savings deposits | Ensures consistent progress |

| Goal Tracking | Visualize achievements | Keeps motivation high |

| Smart Rules | Tailored automation | Optimizes saving efforts |

| Multi-Account Support | Separate goals effectively | Simplifies fund allocation |

With these features, savings automation becomes more streamlined and effective, as demonstrated by tools like Maybe Finance.

Maybe Finance's Automation Tools

Maybe Finance takes automation to the next level by integrating AI-powered insights with user-friendly tools to simplify and enhance savings.

The AI-Powered Insights feature examines your spending habits to uncover opportunities for saving without disrupting your lifestyle. These tailored suggestions help you refine your financial strategy based on your specific needs.

Transaction Categorization organizes your financial activities automatically, making it easier to ensure your spending aligns with your savings goals. With connections to over 10,000 financial institutions, the platform offers a comprehensive view of your finances in one place.

Customizable Rules give you control over your savings strategy. You can set up percentage-based transfers, create conditions based on account balances, and manage multiple savings goals simultaneously.

The platform also offers Visual Analytics, which transform complex financial data into clear, actionable insights. These visuals help you track your progress, stay motivated, and make informed decisions about your savings.

Additionally, Maybe Finance’s open-source design prioritizes transparency and security. You can even self-host the platform, giving you full control over your financial data while benefiting from its advanced automation features.

Making Your Automated Savings Work Better

Growing Your Savings Rate

Boosting your savings rate becomes much easier with the help of smart automation tools. Maybe Finance’s budgeting features are designed to pinpoint opportunities to save more without sacrificing your current lifestyle.

By analyzing your spending habits through Maybe Finance’s category tracking, you can uncover areas to cut back and redirect those funds toward your savings goals. For instance, a closer look at recurring subscriptions might reveal duplicate services or unnecessary expenses that can be trimmed or eliminated altogether.

Set achievable goals for gradually increasing your savings by adjusting your automated transfers over time. The budgeting tools help you make these changes manageable by keeping an eye on your spending trends and category balances.

| Savings Growth Strategy | How to Implement | What to Expect |

|---|---|---|

| Small, Regular Increases | Adjust automated transfers | Gradual, consistent savings growth |

| Spending Analysis | Use AI tools to review expenses | Spot areas to save |

| Balanced Allocations | Apply budgeting rules | Save without lifestyle disruptions |

Managing Extra Income

Unexpected income, like bonuses or tax refunds, can give your savings a big boost. With Maybe Finance, you can create custom rules to automatically direct this extra cash toward your savings goals.

Set up rules to allocate windfalls - whether it’s a bonus, a side hustle paycheck, or a tax refund - into specific savings categories. This ensures that irregular income works for you, keeping your savings plan on track.

After allocating these funds, use the savings dashboard to review your progress and refine your approach as needed.

Tracking Your Progress

Maybe Finance’s dashboard provides a clear, real-time view of your savings progress, helping you see how your automated efforts align with your financial goals.

With these tracking tools, you can:

- Compare your actual savings rate to your targets

- Spot which automation strategies are working well

- Identify areas where adjustments might be needed

Next Steps

Now that you've laid the groundwork with progress tracking, it's time to turn those insights into action. Start implementing your automated savings plan today. Link your accounts to gain a complete view of your finances, and try a small, automated transfer to see how it fits into your budget. Use Maybe Finance's transaction management tools to monitor the daily effects and leverage its AI-driven insights to find ways to gradually increase your savings rate.

Take advantage of Maybe Finance's custom rule-setting feature to handle irregular income more effectively. For instance, you can set up an automatic rule to allocate a portion of any bonuses or tax refunds toward your long-term savings goals, while still keeping some flexibility for other priorities.

| Timeframe | Action | Expected Outcome |

|---|---|---|

| Day 1 | Set up your first automated transfer | Gain full financial visibility |

| Week 1 | Establish savings categories and rules | Create an organized tracking system |

| Month 1 | Evaluate automation performance | Fine-tune transfer amounts |

| Quarter 1 | Review savings patterns and rates | Refine your automation strategy |

As we've covered earlier, tools like automated transfers and AI insights simplify the process of boosting your savings. Make it a habit to review your automated savings system every quarter. Maybe Finance's visualization tools can help you easily track progress and spot areas needing adjustment. This structured approach ensures your plan evolves with your financial needs.

Finally, keep your dashboard updated and set alerts for any major financial changes so you can quickly adjust your strategy and stay aligned with your long-term goals.

FAQs

How can I decide how much to save automatically without straining my monthly budget?

To figure out how much you should automate for savings, begin by taking a close look at your monthly income and expenses. Add up all your essential costs - things like bills, groceries, and other necessities - and see what’s left over.

A common guideline is to save about 20% of your income, but don’t stress if that feels like too much right now. Start with an amount that feels manageable and won’t strain your ability to cover your daily needs. The key is to set goals that fit your current financial situation.

Using tools like Maybe Finance can make this process easier. These tools let you track your spending and get a clear view of your cash flow. They can also highlight areas where you might cut back and free up money for savings. Begin with small steps, keep an eye on your progress, and adjust as your finances improve.

How can I adjust my automated savings plan if my financial situation changes?

If your financial situation takes a turn, it’s a good idea to revisit your automated savings plan to make sure it still fits your current budget and goals. Start by taking a close look at your income, expenses, and savings targets. This will help you figure out what you can reasonably set aside.

Once you’ve got a clear picture, adjust the settings on your automated savings tool or platform. Most platforms give you the flexibility to tweak the amount, frequency, or even where your savings go. For instance, you might temporarily lower the amount you’re saving or redirect funds toward more pressing financial needs.

Using a platform like Maybe Finance makes this process even easier. It lets you track your updated savings alongside your full financial overview, so you can stay on course with your goals - even when life throws you a curveball.

How does Maybe Finance protect my financial data while using its automation tools?

Maybe Finance places a strong emphasis on keeping your financial data secure. As an open-source platform, it offers full transparency, letting users see exactly how their information is managed. This openness allows the community to audit the platform regularly, ensuring there are solid protections in place.

For those who opt to self-host Maybe Finance, the benefits go even further. You gain total control over your data, creating an added layer of privacy and security that aligns with your personal needs. Your financial information is handled with the utmost care and protection every step of the way.

Subscribe to get the latest updates right in your inbox!