How behavioral finance can make you a better investor

To understand how our behavior and the way we view money influence our decisions when it comes to our finances, we can look at the growing field of behavioral finance, which combines the areas of finance and investor psychology/behavior.

Behavioral finance can teach us valuable lessons on the psychological and emotional factors that make us investors susceptible to behavioral biases that influence us to make decisions that work against our financial goals.

What is behavioral finance?

We are all affected by cognitive biases, which cause our brains to make sub-optimal decisions because our brains interpret external data and information through the lens of our personal experiences and preferences.

Behavioral finance seeks to study the effects of human psychology that bring these biases into our approaches to investing and financial markets. Awareness of these different biases and where they come from can help us as investors improve our rational thinking and decision-making abilities.

Traditional finance vs. behavioral finance

To find out how behavioral finance can optimize your investing decisions and improve your portfolio returns, we must first understand how behavioral finance differs from traditional finance.

Rational behavior:

When it comes to traditional finance, the investors and the market are considered rational actors. Investors only make decisions based on economic models and market behavior, gather all the available data and do not form their own biases based on the information they collect. Therefore, investors are completely rational under traditional finance and do not make emotion-driven investing decisions.

However, behavioral finance says that each investor comes with their own cognitive biases and has incomplete information. This means that investors sometimes don't act rationally but are driven by emotions, make errors in judgment, and don't always make the smartest choice.

Efficient markets:

Traditional finance describes financial markets as efficient and perfect as all its constituents (institutions and individual investors) make decisions that are always beneficial for them in the long term. Also, as all participants have complete information and make data-backed decisions, there is no room for anomalies in the market.

Behavioral finance believes that anomalies, bubbles, and irrational valuations of securities exist in the market as investors are sometimes irrational and make decisions that support their biases and limited information. Since investor emotions fluctuate across extremes, behavioral finance believes that the markets aren't efficient and that it is possible to exploit these anomalies.

In summary, behavioral finance considers investors not as rational beings that make the best decisions with the data presented in front of them but as “ normal” actors who are subject to making errors in judgment due to the cognitive biases that affect them.

The importance of behavioral finance

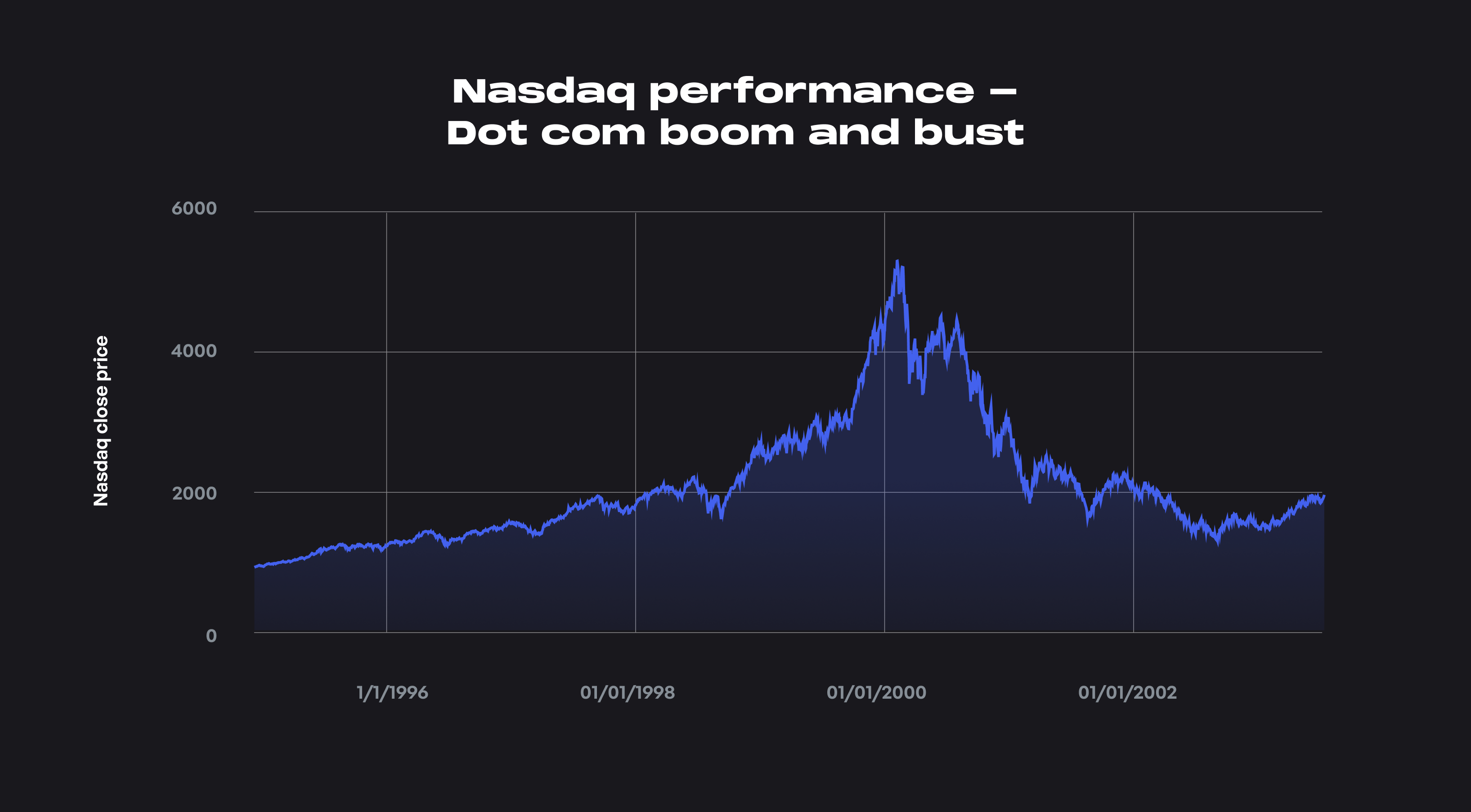

Most of the major booms and busts in the stock market are caused by the investors' emotions, ranging from irrational exuberance to manic depression, and their reaction to external events.

When times are good, the economy is doing well, and external micro and macroeconomic factors are favorable, investors put their money in the market even when the valuations are exorbitantly high. However, in times of crisis and recessions, when companies/indexes are trading at attractive valuations, no one wants to buy equities because of excessive fear in the market.

Many investors were affected by crises such as the Dot-com bubble, the 2008 Financial crisis, etc. But traditional models of finance that treated all investors as rational actors making decisions based on all available information failed to predict these events.

However, observing investor irrationality through the lens of behavioral finance gave economists such as Robert Shiller the ability to predict periods of unjustified market prices. In his book, Irrational Exuberance, Shiller used his behavioral finance theories to predict the crash in IT stocks (2000). In 2005, in an updated version of the book, he wrote about the real estate bubble that was bound to crash shortly. He was right on both occasions.

A high Shiller PE might denote that stocks are overvalued in comparison to historical averages and a low Shiller PE might denote that stocks are undervalued compared to historical averages.

(All data and analysis used above are available here.)

The above shows the importance of behavioral finance and how you can use its concepts (as outlined above) to help you make better investment decisions.

The building blocks of behavioral finance

According to the Corporate Finance Institute, we can break down the errors and biases of investors into at least four main buckets.

1. Self-deception:

According to Wikipedia, self-deception is defined as the process of rationalizing or denying the significance, relevance, or importance of any evidence or arguments of logic that are contrary to one's views about a topic. Self-deception is one of the primary decision-making errors that impede our ability to make rational and reasonable decisions.

We generally think that we know more than we actually do or decide based on more data and information than we had. This leads us to make sub-optimal decisions due to improper information and our biases towards the information we consider essential in making a decision.

How you can overcome self-deception:

When making investment decisions, try to gather as much data and as many differing viewpoints as possible to make a well-rounded decision that takes in almost all available information and perspectives.

2. Heuristic Simplification:

Heuristics are rules of thumb or shortcuts that our brain uses to avoid cognitive strain and make decisions quickly and regularly. However, when the same heuristics are used to make simplistic decisions concerning our finances, it can cause disastrous effects on portfolio returns. Even a tiny error in judgment due to a default decision can cause you to lose substantial capital.

How you can overcome heuristic simplification:

To avoid this group of behavioral errors in your financial journey, it makes sense to put extra thought into making any decision related to your portfolio and finances and resist the urge to make in-the-moment decisions based on defaults or rules of thumb.

3. Emotion:

Emotional investing causes us to be exposed to several cognitive biases, which in turn cause us as investors to buy high during market bubbles and sell at low prices. As a general rule, emotion-driven decision-making, especially in financial markets, can lead to sub-par investment returns in the long run.

How you can reduce emotional decision making:

A simple way to avoid making emotional decisions is to have a diverse set of asset classes and assets (diversify your portfolio), dollar cost average your investments over time to reduce volatility, and theoretically buy low and sell high. These pre-set systems allow you to make fewer decisions according to emotion and more according to the strategy you've already put in place.

4. Social Influence:

Social influence is the bucket that contains all the biases that affect our decision-making abilities due to the external influence of other investors in the market. For example, if most of your friends, family, and colleagues have low to no equity exposure and have not had a good time in the stock market, you'll be inclined to have a lower equity exposure yourself, regardless of whether that is the correct asset allocation for you or not.

How you can reduce social influence on investment decisions:

You can minimize the effects of social influence on your investment decisions by thinking of your finances from a subjective point of view. Personal finance is personal, after all. Making investment decisions based on your risk tolerance and goals can help you reduce the effects of external influence on your financial journey.

Major biases understood through behavioral finance

Understanding the major biases that cause us to make bad financial decisions can help you as an investor check your investing decisions against the various biases and make more informed data-driven decisions.

Self-serving bias:

Self-serving bias is the tendency of humans to credit good outcomes to our skills and bad outcomes to bad luck. Investors also behave the same way and attribute their picking best-performing stocks in their portfolios to their superior knowledge and skill. However, the bad performers they picked lagged due to external factors like increased competition, poor management, industry headwinds, etc.

In reality, the number of external variables that contribute to the stock's performance is so high that it is impossible to predict the future performance of a particular company's stock with any degree of accuracy.

How to limit the effects of self-serving bias:

The only way to limit self-serving bias is by recording the impact of your decisions. For example, if you want to consider stock picking, you could write down your stock picks in a journal and track their performance over a predetermined period. You could also assign a small capital pool towards testing your strategy. Finally, after that period is over, compare the performance of your picks to that of the index and see if you're outperforming the index.

Sometimes, your highest conviction picks would have performed the worst. This exercise can help you identify your strengths and weaknesses and understand the role of luck and randomness, especially in financial markets.

Hindsight bias:

Hindsight bias is one of the main behavioral biases, especially in behavioral finance, where humans (investors in this case) think that they always knew that they were right after an event occurs. Investors presume they had the talent or skill to predict an outcome that could have gone both ways, just because they had the benefit of hindsight or if things went their way.

This is why posts like “If you had invested $1000 in XYZ stock in 2000, you would have $1 million today” don't make sense, as they are viewed through the lens of hindsight. Most investors would not have recognized that particular stock at that point in time. Even if they had recognized it, very few would have had the temperament and conviction to hold it through significant drawdowns over long periods.

How to limit the effects of hindsight bias:

The way to overcome this bias is by rejecting claims, data, and information that have the benefit of hindsight as a deciding factor while making investment decisions. Falling victim to the hindsight bias while making money-related decisions can have disastrous consequences as no one has the benefit of hindsight in the future.

Some of the other major biases, such as anchoring bias, confirmation bias, overconfidence bias , and so on, which also play a significant role in how you make financial decisions, are detailed in this article.

Key takeaways:

- In this article, we began by understanding the basics of behavioral finance and how cognitive biases (errors in judgment) cause our brains to make irrational decisions. We also understood that behavioral finance helps us look at human psychology and its biases, especially in financial markets, and apply behavioral finance principles when making our own investing and money-focused decisions.

- Next, we went on to elucidate the differences in thinking between traditional finance and behavioral finance. Traditional finance considers all investors as rational actors, serving their self-interests and those who take decisions based on all available information using economic models. On the other hand, behavioral finance considers investors as irrational beings who do not make perfect decisions all the time due to their inherent cognitive biases.

- Then, we learned about how traditional economic models failed to predict crisis events such as the Dot-com bust and the 2008 Financial crisis , while Robert Shiller, who used theories of behavioral finance, was able to accurately predict irrationality in the IT sector in 2000, as well as in the housing market in 2008, just by looking at investor behavior.

- Next, we moved on to the four major buckets of behavioral finance: self-deception, heuristic simplification, emotion, and social influence , and what you can do as an investor to overcome these buckets of behavior that cause us to make sub-par investing decisions.

- Finally, we learned about the main biases in behavioral finance (with links to resources to learn about other major biases), such as self-serving bias, hindsight bias, anchoring bias, etc. Understanding these biases can help reduce the influence of these errors in judgment when you make financial decisions.

Subscribe to get the latest updates right in your inbox!